Hodler’s Digest, Oct. 5 – 11 – Cointelegraph Magazine

Top Stories of The Week

Bitcoin plummets to $102K on Binance as Trump announces 100% tariffs on China

US President Donald Trump announced a 100% tariff on China on Friday, sending the price of Bitcoin reeling below $110,000 at the time of writing.

Trump said the tariffs were in response to China attempting to place export restrictions on rare earth minerals, which are crucial for creating computer chips. Trump wrote on Truth Social:

“It has just been learned that China has taken an extraordinarily aggressive position on Trade in sending an extremely hostile letter to the World, stating that they were going to, effective November 1, 2025, impose large-scale Export Controls on virtually every product they make.”

‘Debasement trade’ is no longer a debate, and TradFi knows it: Execs

Financial institutions are quickly waking up to the “debasement trade,” according to commentators, which could be a boon for assets such as gold and Bitcoin.

Institutions have a new concept to cling to called the “debasement trade,” which will be the thing that protects them, said entrepreneur Anthony Pompliano in a podcast on Thursday.

It’s the same thing that goldbugs and Bitcoiners have been talking about for years, and now institutions have just realized that “no one is ever going to stop printing money,” he added. “This now feels like there is no longer a debate about this. People realize the dollar and bonds are going to have a lot of trouble moving forward, and therefore Bitcoin and gold are definitely benefiting.”

Polymarket founder Coplan joins billionaire club after NYSE parent investment: Report

Shayne Coplan, the founder of prediction market Polymarket, is once again in the limelight, as prediction markets shift from regulatory bans in the United States to legitimate financial markets with institutional backing.

Bloomberg named Coplan among the world’s billionaires following a $2 billion investment in Polymarket by New York Stock Exchange parent Intercontinental Exchange.

Coplan launched the platform in 2020 when he was 21 after dropping out of New York University. He often worked on the platform from the bathroom in his New York apartment, he said.

Ethereum DATs are the next Berkshire Hathaway: Consensys founder

Inspired by Michael Saylor’s Bitcoin playbook, Joseph Lubin says Ethereum treasury companies can provide outsized returns on yield and investment opportunities to their Bitcoin counterparts.

Speaking exclusively to Cointelegraph at Token2049 in Singapore, the Ethereum co-founder and Consensys CEO unpacked his thesis for why Ether digital asset treasuries (DATs) present superior opportunities to the Bitcoin treasury movement popularized by Saylor’s Strategy Bitcoin play.

“I’d much rather have something that potentially has more impact. It certainly is as solid as Bitcoin, and I would argue more solid because of the functionality and the organic demand for it to pay for transactions and storage,” Lubin said.

US Bitcoin reserve funding ‘can start anytime’ — Senator Lummis

Crypto-friendly US Senator Cynthia Lummis has confirmed that acquiring funds for the US Strategic Bitcoin Reserve (SBR) can “start anytime” now, though legislative red tape is holding it back.

In an X post on Monday, Lummis said that while it remains a “slog” on the legislative side of things, thanks to “President Trump, the acquisition of funds for an SBR can start anytime.”

Lummis made the comments in response to a post from ProCap BTC chief investment officer Jeff Park, who shared a video of himself and Bitcoin bull Anthony Pompliano discussing the potential of the Strategic Bitcoin Reserve.

Park was hypothesizing what would happen if the government were able to utilize its $1 trillion worth of paper gains from gold to reinvest into Bitcoin.

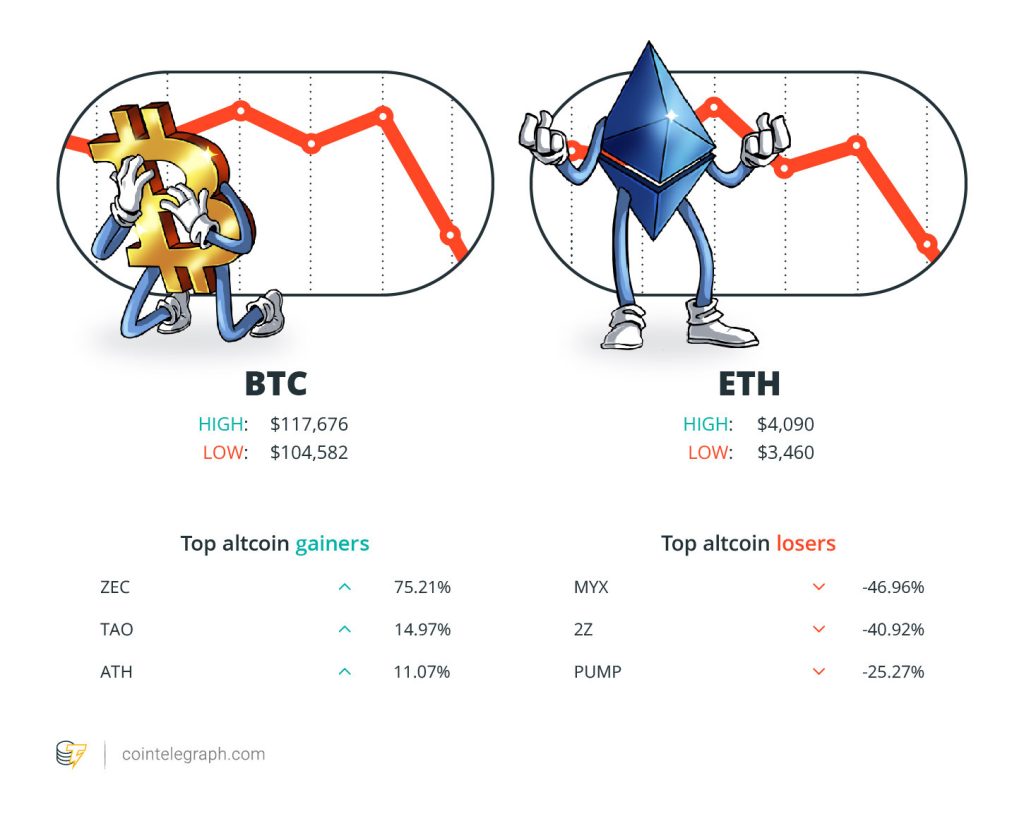

Winners and Losers

At the end of the week, Bitcoin (BTC) is at $117,676 Ether (ETH) at $4,090 and XRP at $2.72. The total market cap is at $4.00 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are ZCash (ZEC) at 75.21%, Bittensor (TAO) at 14.97% and Aethir (ATH) at 11.07%.

The top three altcoin losers of the week are MYX Finance (MYX) at 46.96%, DoubleZero (2Z) at 40.92% and Pump.fun (PUMP) at 25.27%.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“What was once the promise of the free exchange of information is being turned into the ultimate tool of control.”

Pavel Durov, founder and CEO of Telegram

“We want Bitcoin to be everyday money ASAP.”

Jack Dorsey, founder of Square

“You can kind of start lifting some of your targets and saying, ‘Well, because we’ve proven 110, that’s the floor, where do we go from here?’”

James Check, Bitcoin analyst

“Betting against a cycle that has a perfect three-for-three record should not be done with reckless abandon.”

Peter Brandt, veteran trader

“I’d much rather have something that potentially has more impact. It certainly is as solid as Bitcoin, and I would argue more solid because of the functionality and the organic demand for it to pay for transactions and storage.”

Joseph Lubin, co-founder of Ethereum

“At the onset of the pandemic, I quite literally had nothing to lose: 21, running out of money, 2.5 years since I dropped out, and nothing to show for it, but I knew we were entering an era where ways to find truth would matter more than ever.”

Shayne Coplan, founder and CEO of Polymarket

Top Prediction of The Week

Bitcoin may get ‘dragged around a bit’ amid Trump tariff fears: Exec

Swan Bitcoin CEO Cory Klippsten said Bitcoin’s price volatility may not be over after the cryptocurrency briefly fell to $102,000 on Friday, following US President Donald Trump’s announcement of a 100% tariff on Chinese imports.

“If the broader risk-off mood holds, Bitcoin can get dragged around a bit before it finds support and starts to decouple again,” Klippsten told Cointelegraph on Friday.

Read also

Klippsten said that Bitcoiners should expect some turbulence over the coming days. “Macro-driven dips like this usually wash out leveraged traders and weak hands, then reset positioning for the next leg up,” Klippsten said.

“We’ve got a little panic in the markets right now, classic macro whiplash. Trump and China are trading tariff threats, equities are off, and traders are scrambling to derisk,” Klippsten added.

Top FUD of The Week

Trader loses $21M on Hyperliquid after private key leak: How to stay protected

On Thursday, a single user on the decentralized trading platform Hyperliquid lost about $21 million after a private key leak led to an exploit involving the platform’s Hyperdrive lending protocol.

According to blockchain security company PeckShield, the attacker targeted 17.75 million DAI and 3.11 million SyrupUSDC, a synthetic version of the USDC stablecoin used within Hyperdrive, and subsequently bridged the stolen funds to Ethereum.

PeckShield has not confirmed how the private key was compromised.

Major crypto betting platform Shuffle announces user data breach

Shuffle, a leading crypto betting platform, suffered a data breach after its third-party customer service provider was compromised, exposing the data of most of its users.

According to a Friday X post from Shuffle founder Noah Dummett, the company’s customer relationship management service provider, Fast Track, suffered a data breach that exposed its users’ data. Shuffle used the service in question for “programmatic email sending and various communications with users,” suggesting that those messages and email addresses were likely among the exposed data.

Read also

“Unfortunately, it seems that their breach has impacted the majority of our users,” Dummett wrote. He said that the company was investigating how the breach took place and “where this data ended up.”

South Korea ramps up crypto seizures, will target cold wallets

South Korea’s National Tax Service (NTS) is expanding its crackdown on tax evasion, warning that even crypto assets stored in cold wallets will be subject to seizure.

According to a report from local news outlet Hankook Ilbo, an NTS official said the agency is prepared to conduct home searches and confiscate hard drives and cold wallet devices if it suspects that tax delinquents are hiding their crypto assets offline.

“We analyze tax delinquents’ coin transaction history through crypto-tracking programs, and if there is suspicion of offline concealment, we will conduct home searches and seizures,” the NTS spokesperson reportedly said.

Under the country’s National Tax Collection Act, the NTS can request account information from local exchanges, freeze accounts from tax delinquents and liquidate their assets at market value to cover their unpaid taxes.

Top Magazine Stories of The Week

EU’s privacy-killing Chat Control bill delayed — but fight isn’t over

Europe’s Chat Control proposal would make end-to-end messaging encryption useless. Cypherpunks say the battle isn’t over yet.

Alibaba founder’s Ethereum push, whales are 91% of Korean market: Asia Express

Japan is making a bid to reclaim the crypto crown with finance players on its side, while Jack Ma’s fintech empire keeps backing Ethereum-linked ventures and more.

Worldcoin’s less ‘dystopian,’ more cypherpunk rival: Billions Network

World isn’t as dystopian as critics make out, but there are other approaches to fighting AI accounts more aligned with cypherpunk ideals.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Editorial Staff

Cointelegraph Magazine writers and reporters contributed to this article.