Why Did Some Altcoins on Binance Crash to Zero?

Key takeaways

-

Some altcoins, including Cosmos’s ATOM token, briefly fell near zero on Binance during Friday’s crypto market crash.

-

The same altcoins held real market value on other centralized crypto exchanges.

On Oct. 10, the cryptocurrency suffered its most severe downturn since the FTX collapse, with the total market capitalization dropping by approximately $850 billion within hours.

Bitcoin (BTC) fell around 10–15%, from highs near $124,000 to lows of $105,000. However, altcoins fared far worse, especially those traded on Binance, with many plunging 99.99-100% in minutes.

That includes tokens like Cosmos (ATOM), IoTeX (IOTX), and Enjin (ENJ), whose prices on Binance briefly hit zero.

In comparison, ATOM plunged 53% on rival exchanges, while IOTX and ENJ slipped 46% and 64.5%, respectively. None of them, however, hit zero valuations anywhere else, a phenomenon seen exclusively on Binance.

Why did these altcoins fall to zero?

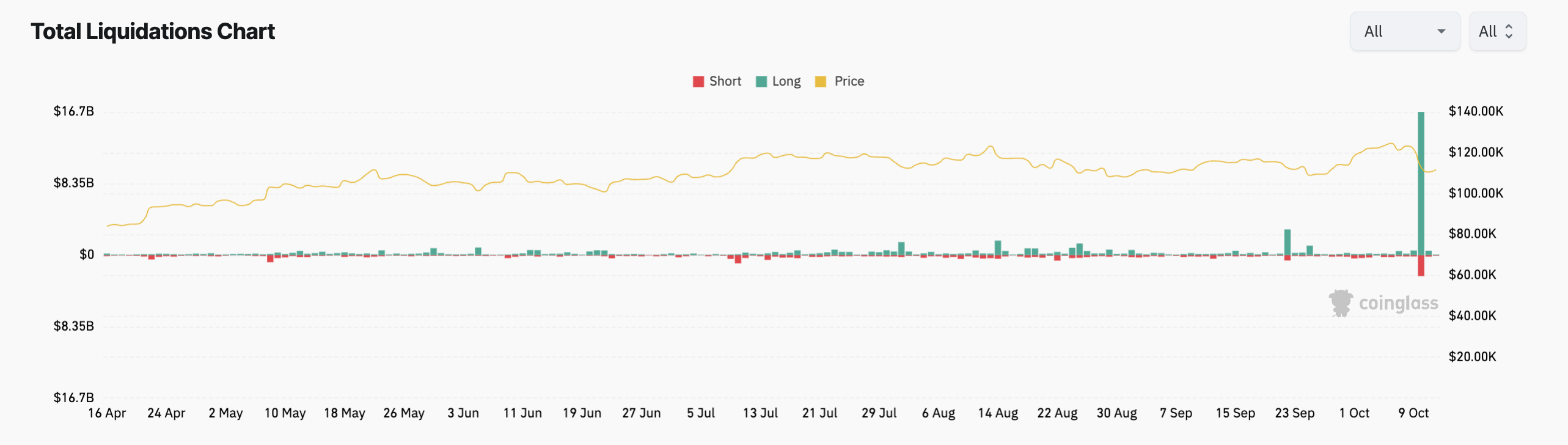

Nearly $20 billion worth of crypto positions were liquidated during the Oct. 9-10 crash, about 20 times more than during the 2020 COVID-19 market rout. Over 1.6 million traders lost their positions as leverage wiped them out.

Many of these traders used leverage (borrowed money) on Binance to boost their profits.

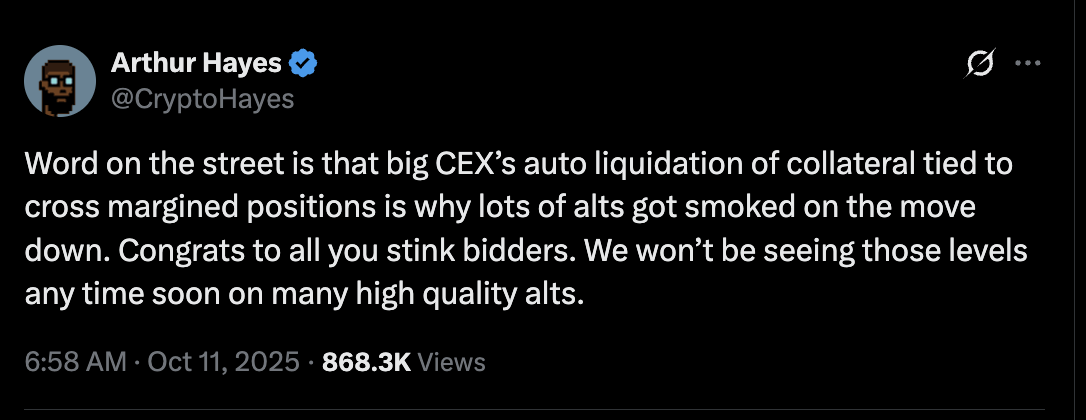

BitMEX co-founder Arthur Hayes said that major exchanges, including Binance, were “liquidating collateral tied to cross-margin positions,” which exacerbated the sell-off.

Simply put, when prices started falling, Binance automatically sold altcoins used as collateral to cover losses. This caused more selling pressure, which pushed prices down even faster.

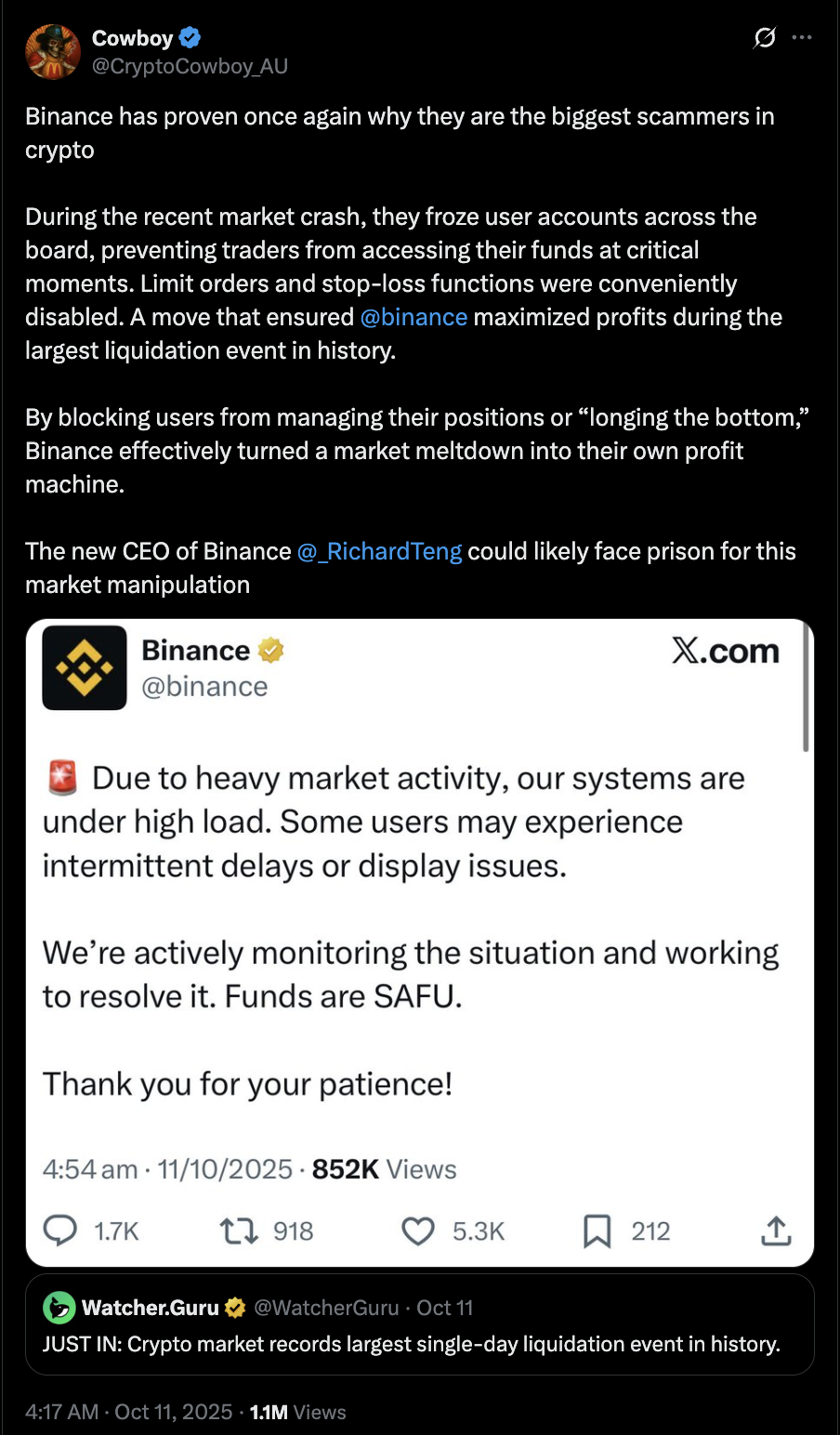

As prices plunged, Binance’s trading systems became overloaded. Some users reported frozen accounts, missed stop-losses, and delayed trades.

At the same time, some analysts stated that market makers like Wintermute withdrew their funds from Binance due to these delays.

Related: Crypto.com CEO calls for probe into exchanges after $20B liquidations

That meant there were no buy orders left for a few moments, so the system showed “zero” prices for some coins, even though the tokens still had value elsewhere.

A similar “flash crash” happened in 2017, when Ethereum briefly fell to $0.10 on GDAX after a flood of automatic sell orders.

Binance issues an apology

Binance co-founder Yi He (Chief Customer Service Officer) issued an apology, saying that “some users have encountered issues with their transactions” amid extreme volatility and surging platform traffic.

CEO Richard Teng also apologized, stating:

“I’m truly sorry to everyone who was impacted. We don’t make excuses — we listen closely, learn from what happened, and are committed to doing better.”

Binance stated that it will compensate users with verifiable losses directly tied to platform or system failures, clarifying that losses resulting from price fluctuations or unrealized gains are not eligible for compensation.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.