Bitmine Buys 2.5% of ETH supply, Scoops Up $827M Post-Crash

BitMine, the world’s largest corporate Ether holder, capitalized on this weekend’s crypto market crash to buy the dip, signaling more institutional confidence in Ether’s continued momentum.

The company said it acquired Ether (ETH) “more aggressively” during the market turmoil, pushing its total holdings past 3 million ETH, or about 2.5% of the cryptocurrency’s total supply. BitMine’s average purchase price was $4,154 per token.

Over the past few days, BitMine acquired 202,037 ETH, worth approximately $827 million, the company announced in a Monday X post.

This brings BitMine’s total holdings to $13.4 billion, which includes $12.9 billion in crypto and “moonshots” holdings, 192 Bitcoin (BTC), $104 million in cash and a $135 million stake in Nasdaq-listed technology company Eightco Holdings.

BitMine’s aggressive buying may influence other corporate crypto treasuries to adopt a similar long-term accumulation strategy.

BitMine’s acquisitions come as the cryptocurrency market experienced a drastic correction on Friday, which led to a $19 billion liquidation event over the weekend.

Related: Ethereum layer 2s outperform crypto relief rally after $19B crash

BitMine accelerates Ether accumulation plan

The latest purchases bring BitMine “halfway” toward fulfilling its treasury goals.

“The crypto liquidation over the past few days created a price decline in ETH, which BitMine took advantage of,” said Tom Lee, chairman of BitMine and head of research at Fundstrat.

“We are now more than halfway towards our initial pursuit of the ‘alchemy of 5%’ of ETH.”

“Volatility creates deleveraging, and this can cause assets to trade at substantial discounts to fundamentals, or as we say, ‘substantial discount to the future,’ and this creates advantages for investors, at the expense of traders,” Lee added.

Related: Ethereum DATs are the next Berkshire Hathaway: Consensys founder

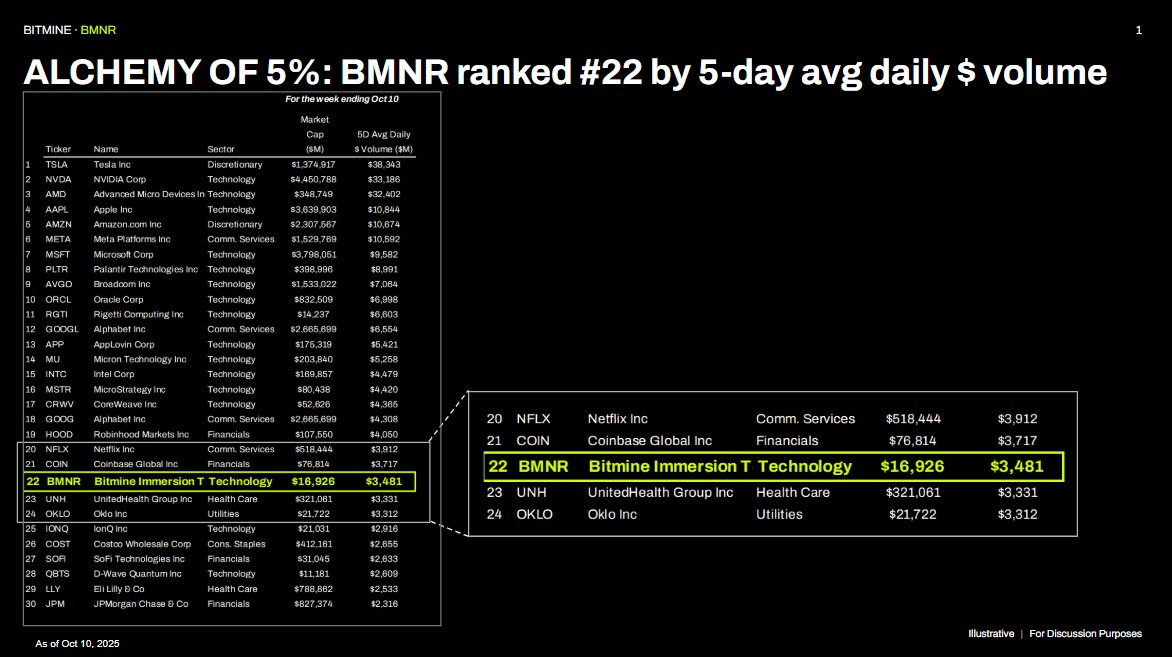

BitMine’s stock is also gaining interest among traditional investors.

BMNR was the 22nd most widely traded stock on US markets, based on its average five-day trading volume of over $3.5 billion, as of Oct. 10.

However, BitMine’s stock price fell 11% over the past five days, according to Google Finance data. The decline occurred days after Kerrisdale Capital took a short position on BMNR on Wednesday, after criticizing the company’s business model for being “on its way to extinction.”

https://www.youtube.com/watch?v=haInlj7rTSs

Magazine: Bitcoin to see ‘one more big thrust’ to $150K, ETH pressure builds