Bitcoin, Ether ETFs Rebound as Powell Signals Rate Cuts

US spot Bitcoin and Ether exchange-traded funds (ETFs) saw inflows on Tuesday as Federal Reserve Chair Jerome Powell hinted further rate cuts could arrive before year-end.

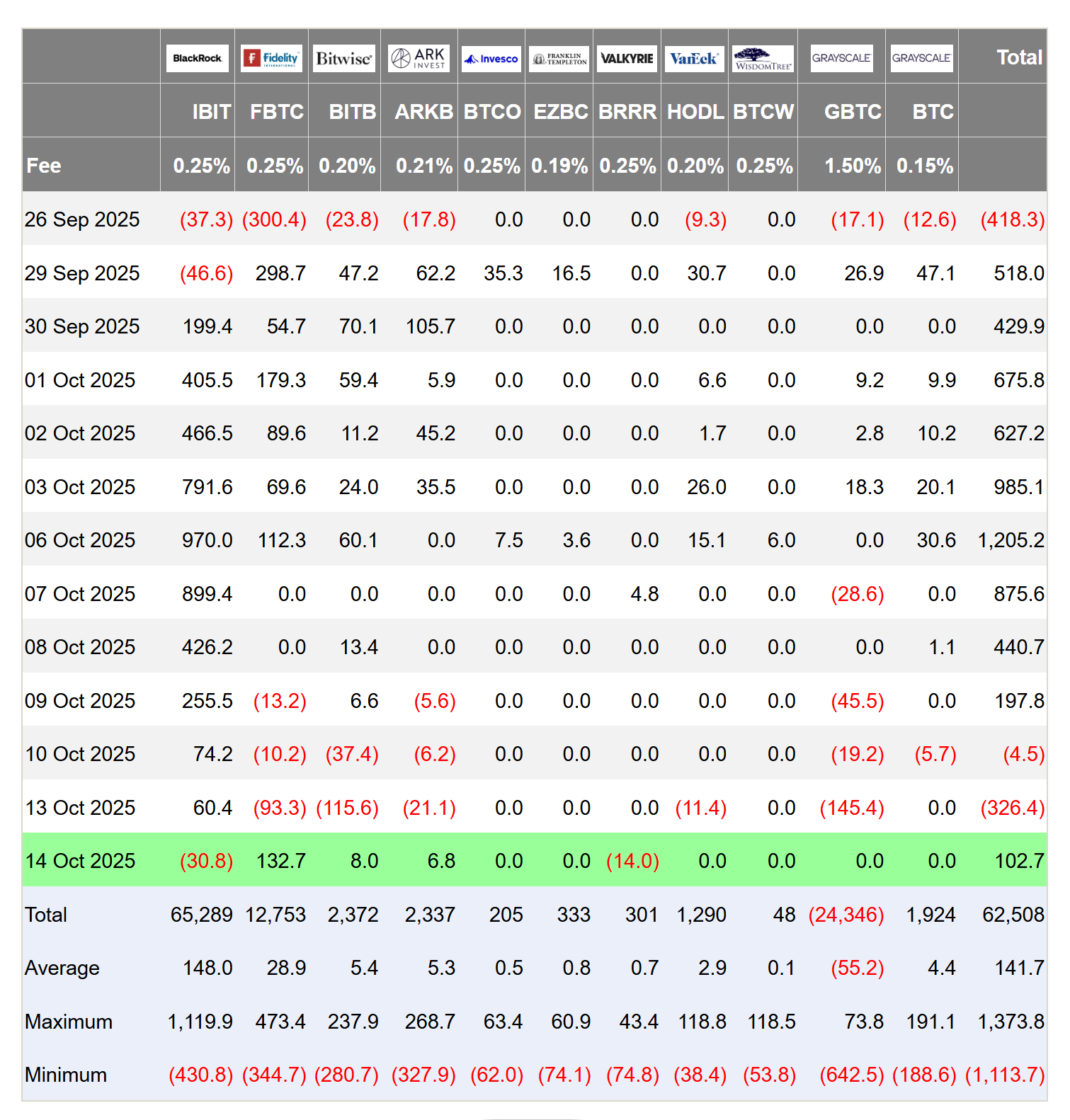

Spot Bitcoin (BTC) ETFs saw $102.58 million in net inflows, rebounding from a $326 million outflow just a day earlier, according to data from SoSoValue. Fidelity’s Wise Origin Bitcoin Fund (FBTC) led gains with $132.67 million in inflows, while BlackRock’s iShares Bitcoin Trust (IBIT) posted a modest outflow of $30.79 million.

Total net assets across all spot Bitcoin ETFs reached $153.55 billion, representing 6.82% of Bitcoin’s market cap, while cumulative inflows stood at $62.55 billion.

Ether (ETH) ETFs mirrored the turnaround, recording $236.22 million in net inflows following Monday’s steep $428 million outflow. Fidelity’s Ethereum Fund (FETH) topped the list with $154.62 million, followed by Grayscale’s Ethereum Fund (ETH) and Bitwise’s Ethereum ETF (ETHW) with $34.78 million and $13.27 million, respectively.

Related: US spot Bitcoin, Ether ETFs shed $755M after crypto market crash

Powell hints at more rate cuts

Federal Reserve Chair Jerome Powell signaled Tuesday that the US central bank is nearing the end of its balance sheet reduction program and is preparing for potential rate cuts as the labor market weakens.

Speaking at the National Association for Business Economics conference, Powell said the Fed may soon stop its “quantitative tightening” process, noting that reserves are “somewhat above the level” consistent with ample liquidity.

“An October rate cut will have markets taking flight, with crypto and ETFs seeing liquidity flow and sharper moves,” Vincent Liu, chief investment officer of the Taiwan-based company Kronos Research, told Cointelegraph.

“Expect digital assets to feel the lift as capital seeks efficiency in a softer rate environment,” he added.

Related: Bitcoin ETFs maintain ‘Uptober’ momentum with $2.71B in weekly inflows

Crypto products stay resilient amid recent crash

As Cointelegraph reported, crypto investment products showed strong resilience during last week’s market turbulence, recording $3.17 billion in inflows despite a major flash crash triggered by renewed US-China tariff tensions, according to CoinShares.

CoinShares said Monday that last Friday’s panic led to only $159 million in outflows, even as $20 billion in positions were liquidated across exchanges. The resilience helped push total inflows for 2025 to $48.7 billion, already surpassing last year’s total.

“Easing US-China tariff tensions and a renewed debasement trade echoed in gold’s strength are fueling fresh demand for digital assets,” Liu noted.

Magazine: EU’s privacy-killing Chat Control bill delayed — but fight isn’t over