Stablecoins Are Replacing Speculative Tokens in Gaming Economies

Stablecoins are taking on a new role in the $350-billion global gaming market, according to a new report published by the Blockchain Gaming Alliance (BGA).

The BGA report argued that fiat-pegged digital assets, once viewed as only payment tools or decentralized finance (DeFi) liquidity, are now becoming the unseen financial infrastructure that would power how developers pay creators, price items and retain players.

The report states that stablecoins like USDt (USDT) or USDC (USDC) offer the economic stability that speculative tokens lack. By eliminating volatility from in-game economies, they enable predictability, faster payouts and seamless asset exchange across platforms.

Because of this, developers increasingly see stablecoins as the “monetary operating system” for gaming’s next growth cycle, the report said.

Gamers choose stability over speculation

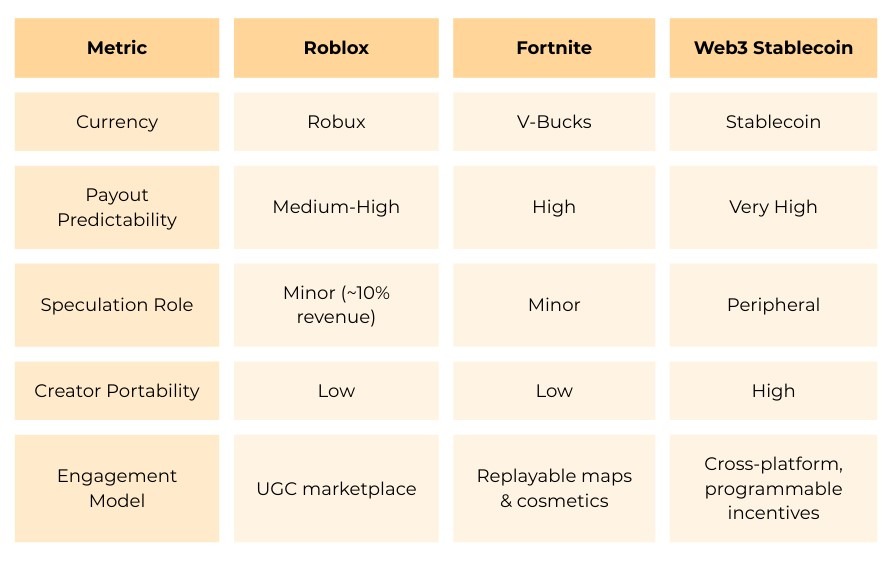

Citing games like Roblox and Fortnite as case studies, the BGA said closed-loop currencies proved how stable values enable users to keep spending and creators building.

According to the BGA, the top 10 Roblox creators earn an average of $38 million annually. The BGA said this income is made possible by fixed exchange rates that insulate them from market shocks.

BGA said this same predictability can be found on stablecoins, which merge the reliability of fiat-backed systems with the transparency and programmability offered by blockchain technology.

“Stablecoins are transforming fragmented, speculative game economies into scalable, player-first systems,” Sequence head of business development Amber Cortez said in the report.

The BGA report framed the shift into stablecoins as a response to the failings of play-to-earn (P2E) models powered by speculative tokens.

The BGA said games like Axie Infinity saw their user numbers collapse after their token values crashed. The report said this exposed how financial volatility undermines user engagement.

“The success of gaming’s biggest economies rests on stable value,” the report said. “Stablecoins bring that principle into the open metaverse—turning virtual currencies into real-world financial rails.”

Early examples of gaming-focused stablecoins have already started to emerge. In May, blockchain network Sui announced that it would release Game Dollar, a programmable stablecoin dedicated to gaming.

Related: Swiss regulator GESPA takes aim at FIFA’s NFT platform in formal complaint

Blockchain gaming venture capital flow sees revival in Q3

In Q3 2025, the blockchain gaming industry saw its strongest investment quarter this year, recording $129 million in venture capital flow.

This brings the total for the entire year to nearly $300 million, according to data platform DappRadar.

However, even though the sector is seeing a glimpse of hope, the numbers are significantly lower compared to last year. In 2024, DappRadar recorded over $1.8 billion in funding flowing into the blockchain gaming space.

https://www.youtube.com/watch?v=GpwmroGcVLc

Magazine: Back to Ethereum: How Synthetix, Ronin and Celo saw the light