WLFI Advisor Bets $2.2M AVAX, 10x Leverage After $550M Avalanche Treasury

Large cryptocurrency investors and a major crypto project adviser are betting millions on the price appreciation of the Avalanche smart contract blockchain’s native utility token following the latest corporate treasury announcement and Avalanche exchange-traded fund (ETF) filings.

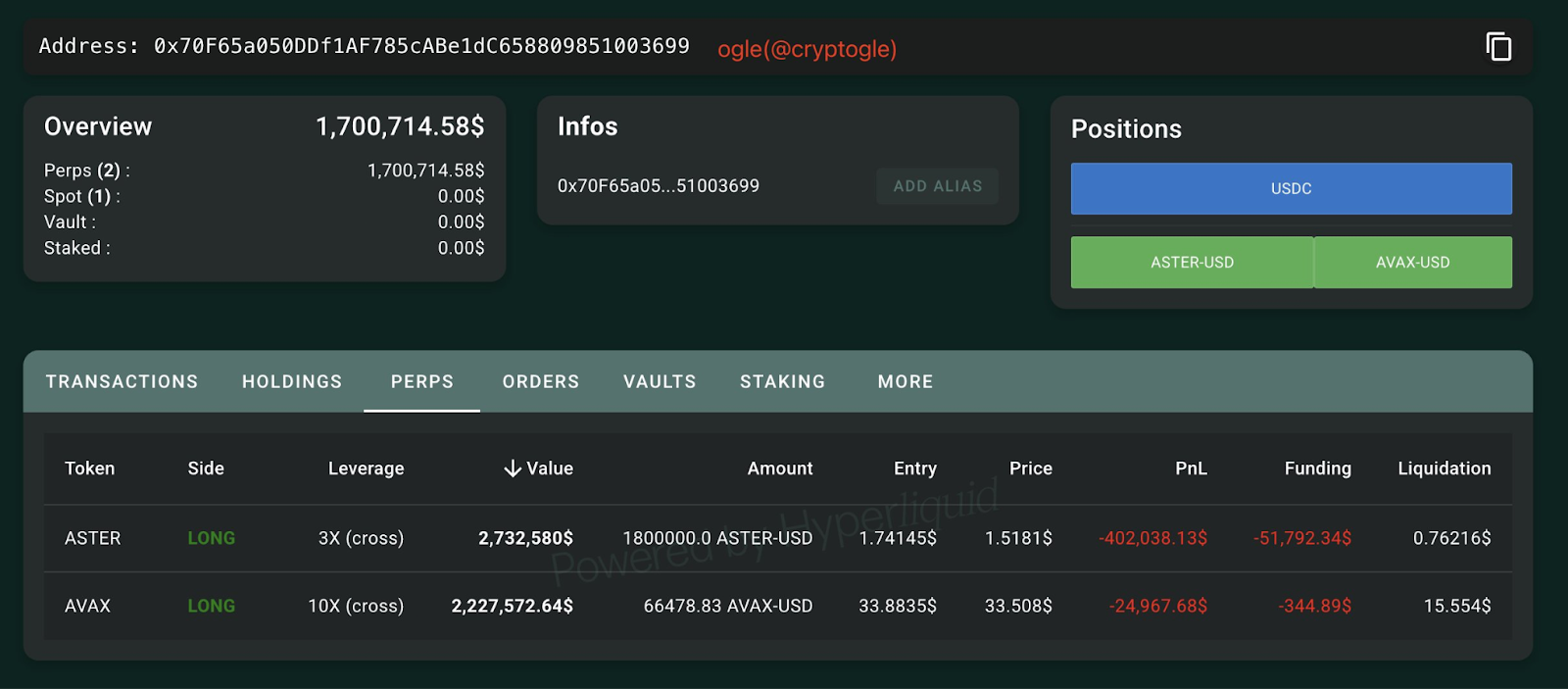

Popular crypto sleuth and World Liberty Financial (WLFI) adviser, Ogle, opened a $2.2 million long position with 10x leverage, betting on the Avalanche (AVAX) token’s price increase.

The position was opened at an entry price of $33.88 and faces liquidation if the AVAX token falls below $15.5, according to blockchain data platform Lookonchain.

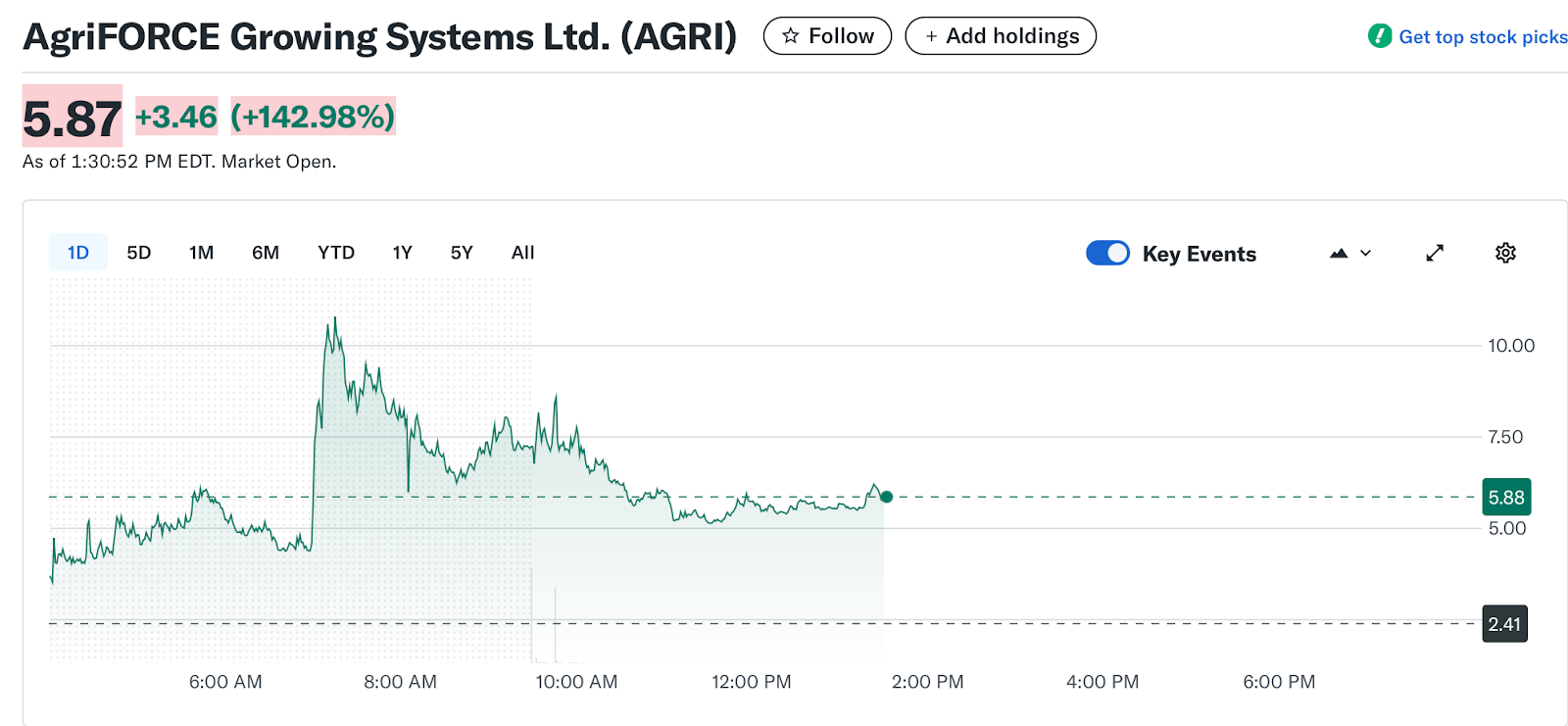

The WLFI adviser placed his leveraged bet shortly after agricultural technology company AgriFORCE Growing Systems announced a strategic pivot to launch a $550 million AVAX corporate treasury.

The company will rebrand to AVAX One and plans to accumulate a total of $700 million in AVAX tokens as part of its long-term strategy. The company’s shares soared by over 200% at Monday’s open after the AVAX treasury announcement, Cointelegraph reported earlier on Tuesday.

The company’s advisory board will be led by Anthony Scaramucci, founder of SkyBridge Capital and a prominent crypto investor, and Brett Tejpaul, the head of Coinbase Institutional.

Whales are also seeking increasing exposure to AVAX. Whale wallet “0xb2ca” opened an AVAX long position with 5x leverage worth $17.2 million and has already generated over $900,000 in unrealized profit within 9 hours.

Related: Avalanche, Toyota Blockchain designing autonomous robotaxi infrastructure

AVAX still 76% down from its all-time high despite rising corporate adoption

Following the latest treasury announcement, the AVAX token rose over 10.8% in the past 24 hours and traded at $34.45 at the time of writing.

Despite the latest wave of corporate adoption, the AVAX token remains over 76% lower than its all-time high of $146 set almost four years ago on Nov. 21, 2021, TradingView data shows.

Related: Avalanche leads blockchain transaction growth amid US gov’t implementation

The Avalanche Foundation — a nonprofit behind the development of the Avalanche blockchain network — is also in discussions with investors to raise a $1 billion crypto treasury vehicle to acquire AVAX tokens at a discount price, the Financial Times reported on Thursday, citing sources familiar with the matter.

The raise includes two potential deals, with the first aiming to raise $500 million in a private placement led by New York-based blockchain investment company Hivemind Capital.

Adding to the growing investor interest in AVAX, crypto-focused asset management company Grayscale filed an updated Form S-1 with the US Securities and Exchange Commission for its spot Avalanche ETF on Aug. 25, Cointelegraph reported.

Magazine: Altcoin season 2025 is almost here… but the rules have changed