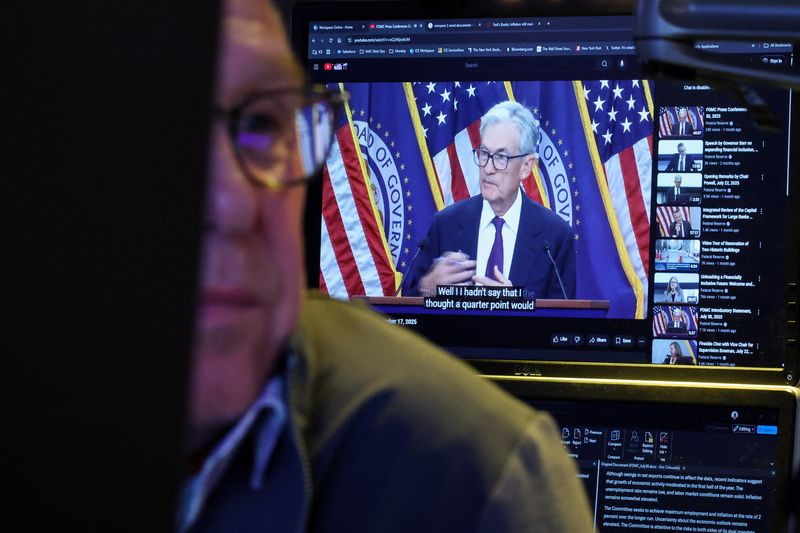

Fed’s Powell repeats no risk-free path as job, inflation risks weighed

NEW YORK (Reuters) -U.S. Federal Reserve Chair Jerome Powell said on Tuesday the central bank is in a “challenging situation” with an ongoing risk of faster-than-expected inflation at the same time that weak job growth has raised concern about the health of the labor market.

In prepared comments to Rhode Island’s Greater Providence Chamber of Commerce, Powell offered little indication of when he thinks the Fed might next cut interest rates, noting that there was danger to both cutting too fast and risking a new surge of inflation, or reducing rates too slowly and possibly causing unemployment to rise unnecessarily.

MARKET REACTION

STOCKS: The S&P 500 held declines and was last down 18.42 points, or 0.27%, to 6,675.44.

BONDS: Treasury yields moved lower, with the yield on the benchmark U.S. 10-year note off 0.4 basis point to 4.141% and the two-year note yield off 0.2 basis point to 3.599%.

FOREX: The dollar index briefly strengthened before reversing and was last down 0.05% to 97.27.

COMMENTS:

OLIVER PURSCHE, SENIOR VICE PRESIDENT, WEALTHSPIRE ADVISORS, NEW YORK:

“I think market participants have priced in 50 basis points worth of cuts (this year). We’ve gotten 25. And (Powell’s) comments, along with the comments from the other Fed governor yesterday, put doubt into whether or not we’re going to see another rate cut this year.

“As we’ve seen for the better part of this year, while there’s certainly been resilience in the economy, the data has hardly been even and consistent and is now dipping to more of a slowdown.

“The economy is surprisingly resilient and the consumer is surprisingly resilient. However, we know from history that when the job market starts to weaken and we shift from a lack of hiring to layoffs, which is the fear; it hasn’t materialized, but that’s the concern. Then the consumer tends to also slow down. And heading into the fourth quarter, that’s potentially problematic. I think that the market needs to start to consider that as a very real possibility.

“And by the way, Powell has flat-out said that. In these prepared remarks he says that inflation risks are real and persistent, and that’s what’s putting them in such a difficult position.”

“The take-away should be that, with this being the third year of double digit returns for the S&P 500, there needs to be another strong catalyst to move stocks materially higher. And right now, it is not clear what that catalyst can be.”

(Compiled by the Global Finance & Markets Breaking News team)