Google Buys 5.4% of Cipher Mining With $3B Fluidstack Deal

Google has acquired a 5.4% stake in Bitcoin mining company Cipher Mining as part of a $3 billion multi-year data center deal with artificial intelligence data center company Fluidstack.

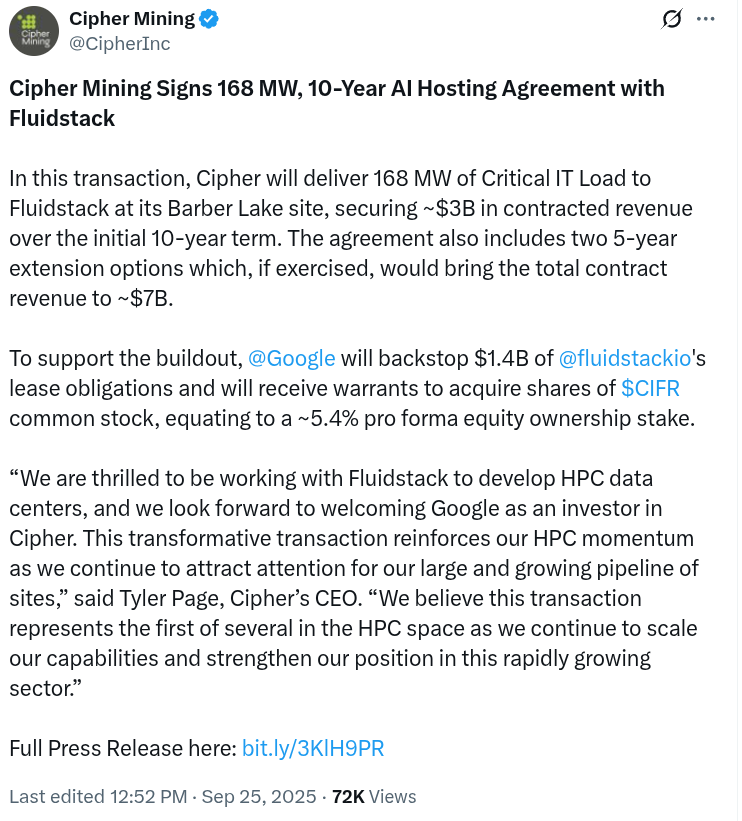

According to a Thursday announcement, Google will receive its stake in Cipher Mining in exchange for guaranteeing $1.4 billion of Fluidstack’s obligations in the contract with Cipher. This plays a part in a larger $3 billion Fluidstack deal with Cipher to lease computing power for 10 years.

The news follows another, similar deal between Google and Fluidstack. In late August, the internet search behemoth became the largest shareholder of Bitcoin (BTC) miner TeraWulf by acquiring 14% of the company in exchange for guaranteeing obligations in a separate Fluidstack deal.

The deal will see Cipher deliver 168 megawatts of computing power to Fluidstack, supported by a maximum of 244 MW of gross capacity, at its Barber Lake site in Colorado City, Texas. The site is also capable of reaching a total capacity of 500 megawatts and possesses 587 acres of surrounding land.

Related: The $3.5B shift: How Bitcoin miners are cashing in on AI

Deal strengthens AI mining crossover

Google will backstop $1.4 billion of Fluidstack’s lease obligations to Cipher Mining. In exchange, the internet giant will receive warrants to acquire approximately 24 million shares of Cipher common stock, equating to an approximately 5.4% pro forma equity ownership stake.

Cipher CEO Tyler Page said the deal reinforces the company’s high-performance computing (HPC) momentum. “We believe this transaction represents the first of several in the HPC space as we continue to scale our capabilities and strengthen our position in this rapidly growing sector,” he said.

The deal underscores a broader trend of crypto mining firms shifting into artificial intelligence computing. Earlier this week, CleanSpark announced a $100 million financing round partly earmarked for AI infrastructure, sending its stock up 5% in after-hours trading.

Related: Hive Digital accelerates AI pivot with $100M HPC expansion — Cointelegraph exclusive

A mid-September analysis from The Miner Mag revealed that Bitcoin mining stocks extended their recovery, outpacing Bitcoin. The trend was partly explained by investors rewarding miners pursuing GPU and AI pivots.

Other miners, including Hive Digital, have also expanded into GPU and AI services. In mid-August, the company reported record revenue and earnings in its fiscal first quarter.

Magazine: AI may already use more power than Bitcoin — and it threatens Bitcoin mining