Streamex Stock Jumps on Gold-Backed Stablecoin Launch

Streamex saw its stock surge over 20% on Monday after announcing a pre-sale for its upcoming gold-backed stablecoin, GLDY. The digital asset, designed to generate an annualized yield of up to 4.0%, will open for qualified investors on or before Nov. 10.

The GLDY token offers exposure to physical gold bullion with yield paid in ounces of gold, targeting institutional investors, the firm announced on Monday. The stablecoin is part of Streamex’s broader mission to tokenize real-world commodities through digital instruments.

“The launch of GLDY represents a major evolution in how investors can access and benefit from physical gold,” said Henry McPhie, co-founder and CEO of Streamex. “Now, instead of paying to hold gold, investors can get paid to hold gold.”

The GLDY pre-sale includes an initial capacity of $100 million, with Streamex itself committing at least $5 million. The company says issuance could expand to $1 billion, depending on demand. Yield is generated through gold leasing deals backed by Streamex’s exclusive partnership with Monetary Metals.

Related: Standard Chartered says $1T may exit emerging market banks to stablecoins by 2028

Streamex sets $200,000 minimum for GLDY investors

Participation in the GLDY token sale is limited to accredited individuals and institutions. The minimum investment stands at $200,000 for individuals and $1 million for institutional entities.

“The combination of capital preservation, liquidity, and yield denominated in ounces is purpose-built for portfolio managers, ETFs and institutional balance sheets seeking durable cash management, and diversified commodity exposure,” McPhie said.

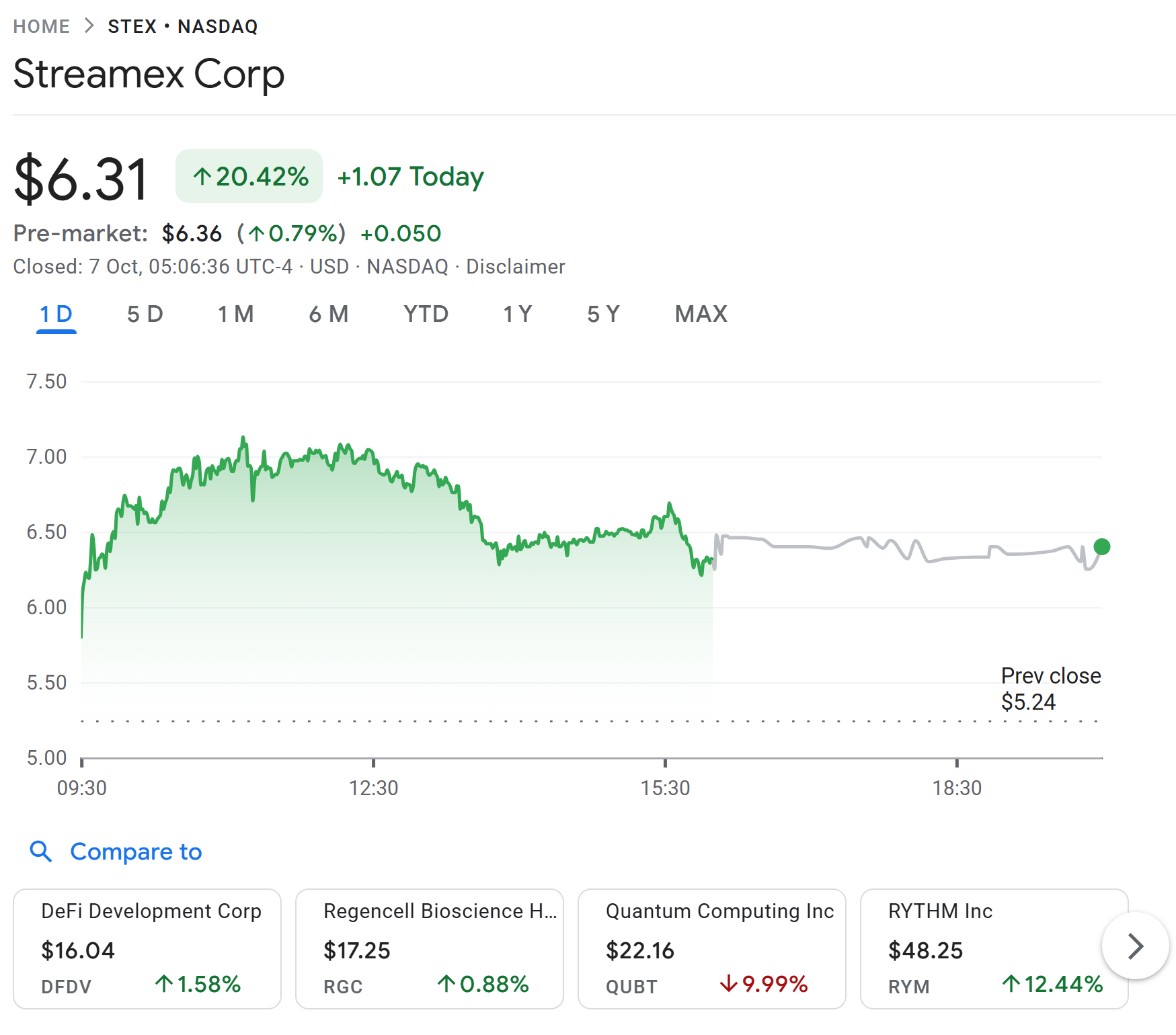

The market responded swiftly to the announcement, with Streamex shares jumping 20.42% on the day and continuing to trade slightly higher in the pre-market session, according to data from Google Finance.

The new initiative comes after Streamex and BioSig secured $1.1 billion in growth funding to launch a gold-backed, onchain treasury business in July.

Related: Tether denies Bitcoin sell-off rumors, confirms buying BTC, gold, land

Crypto companies pivot into gold for diversification

Streamex’s launch of its gold-backed stablecoin comes amid increasing demand from crypto companies for gold exposure.

In June, Tether, the issuer of the world’s largest stablecoin, acquired a 32% stake in Canada’s public gold royalty firm Elemental Altus Royalties. Last month, the firm also began discussions with mining and investment groups about deploying capital across the gold supply chain.

Magazine: Quitting Trump’s top crypto job wasn’t easy: Bo Hines