BNB Chain Memecoin Season Hits Wall As Coin Prices Fall 30%

Key takeaways:

-

Binance’s new “Meme Rush” launchpad promotes fair launches but triggered a sell-off as traders await new launches.

-

A single wallet controlled large token amounts, fueling manipulation concerns and steep price declines.

-

Low liquidity and inflated volumes amplified the memecoin sell-off across the BNB Chain ecosystem.

Multiple BNB Chain memecoins tumbled more than 30% on Thursday after posting strong gains earlier in the week. The sell-off occurred as BNB (BNB) itself recorded its first-ever $100 single-day price drop, falling to $1,246 at the time of writing. Is this the end of the BNB Chain memecoin frenzy — and were there any early signs before the crash?

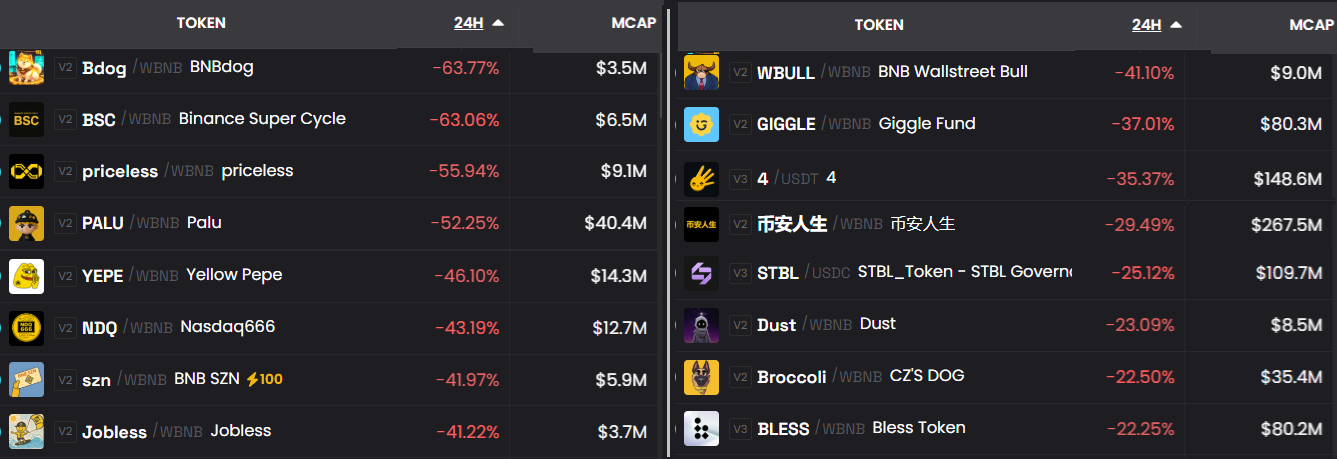

Most of the affected memecoins had market capitalizations under $50 million, though a few stood out amid the downturn, including PALU, GIGGLE, 4, and Binance Life (币安人生). Some analysts suggest that sentiment shifted after Binance announced the launch of its new platform, Meme Rush, on Thursday, a partnership with Four.Meme available exclusively to Binance Wallet users.

Beyond the standard bonding curve model and listings on DEXs once a $1 million fully diluted valuation is reached, Meme Rush introduces possible offerings on Binance Alpha, giving the entire Binance user base access to new tokens. The initiative aims to curb fake trading volumes through KYC requirements and fair-launch mechanics, though the move has drawn some criticism.

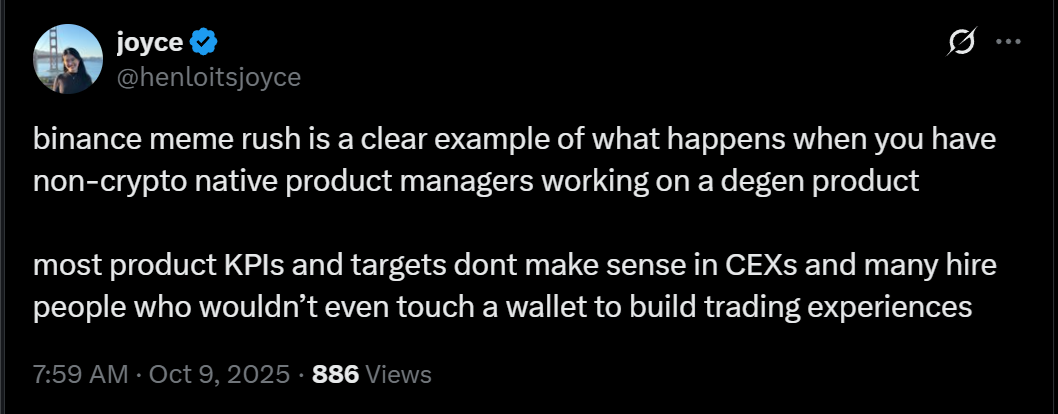

X user henloitsjoyce argued that “degen” products like memecoin launchpads don’t align with centralized exchanges’ performance goals or key metrics. Perhaps the real reason behind memecoins’ success lies in their lack of regulation and oversight. Still, traders likely sold off existing BNB Chain memecoins in anticipation of migrating to the newly announced platform.

BNB Chain memecoins impacted by high concentration and fake volumes

Even with profit-taking and the urge to rotate capital ahead of the next wave of memecoin launches, a few more factors were needed to trigger a 40% drop in just a few hours. Excessive concentration among top wallets, relatively low liquidity, and artificially inflated volumes were likely the main drivers behind the sharp downturn in the BNB meme season.

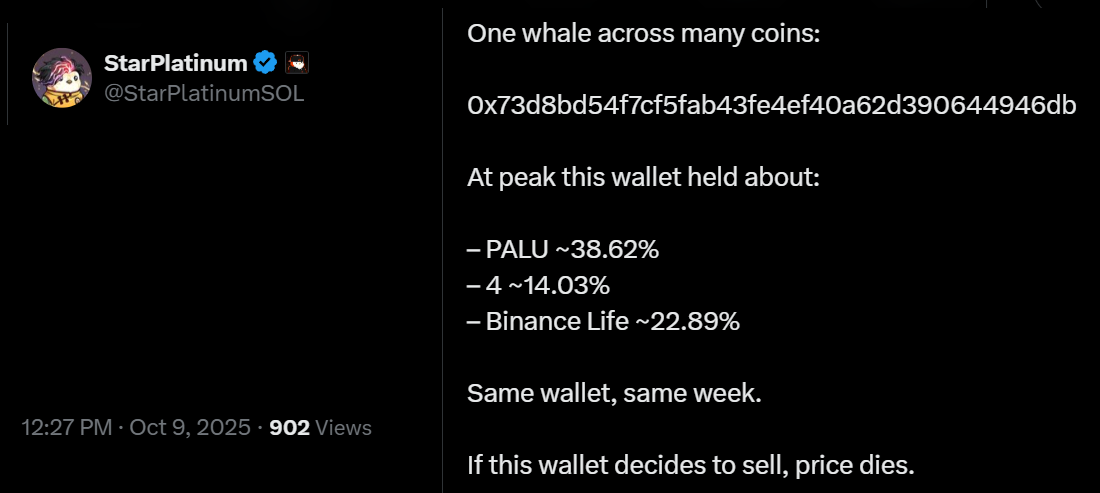

X user StarPlatinumSOL claimed that a single wallet controlled nearly 39% of PALU’s supply at its peak, along with 23% of Binance Life (币安人生) and 14% of 4. Likewise, one wallet reportedly executed batched transactions of $100,000 or more across multiple tokens, suggesting possible fake trading volumes. The user also noted that some memecoins had less than 2.5% of their total supply deposited in liquidity pools.

Unlike traditional bid-and-offer order books, most DEXs operate through automated market makers based on liquidity pools, a challenge not unique to BNB Chain. When only a small portion of a token’s supply is locked in liquidity, inflows can sharply inflate market capitalization, but the same structure accelerates price crashes once sell orders intensify.

Related: How Aster, Lighter and Hyperliquid are competing for the next era of onchain trading

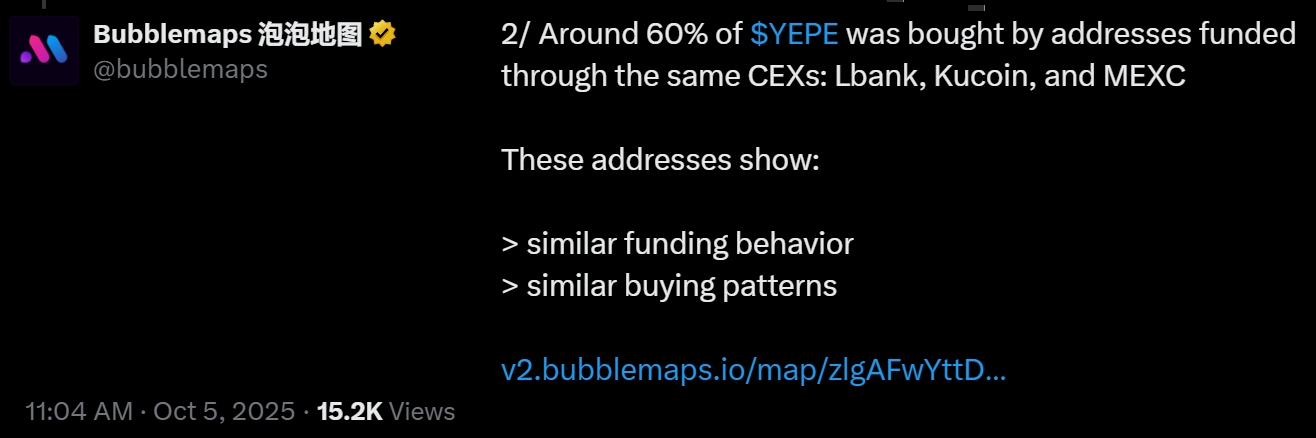

More concerningly, X account Bubblemaps observed that a single wallet purchased around $100,000 worth of PALU just minutes before former Binance co-founder Changpeng “CZ” Zhao posted an image featuring the memecoin’s logo. The timing fueled speculation about coordinated trading activity. Bubblemaps also noted that “insiders” held an unusually large share of certain projects, such as YEPE, where insiders reportedly controlled about 60% of the supply.

The fact that BNB itself dropped 9.5% from its $1,357 all-time high on Tuesday further accelerated the correction across the memecoin market. Ultimately, the sustainability of the BNB Chain memecoin season may depend on whether BNB can reclaim the $1,300 level and if Binance Wallet’s launchpad initiative proves successful.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.