Here’s Why Ethereum Analysts Say ETH Price is Ready for ‘Trend Switch’

Key takeaways:

-

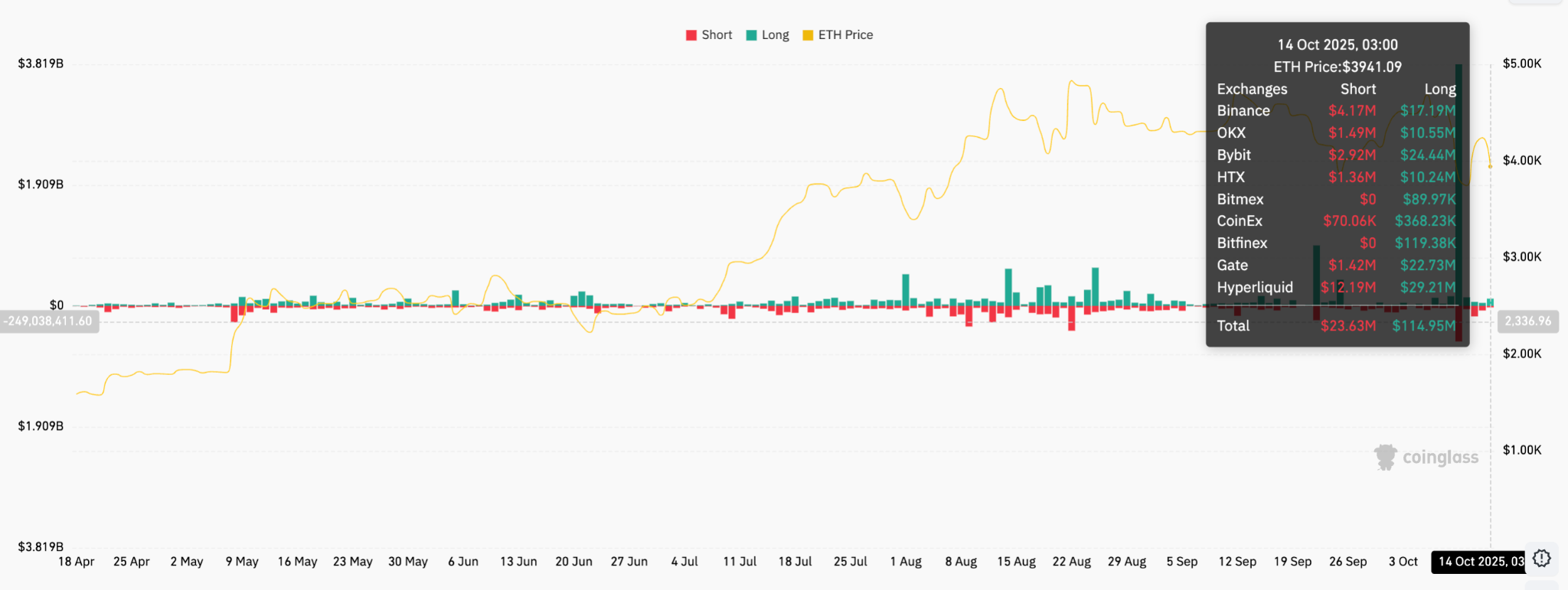

Ether price dropped 8% to $3,940 on Tuesday, triggering $115 million in long ETH liquidations.

-

A bull flag on the weekly chart suggests a $10,000 target, but bulls must hold $3,800 first.

Ether (ETH) was down on Tuesday, dropping more than 8% from Monday’s highs above $4,300 to trade at $3,940. Despite this correction, traders remain optimistic that the ETH price will rise higher as long as key support levels hold.

Ether wipes out $115 million in long ETH positions

Ether’s bearish performance today was accompanied by significant liquidations across the crypto market.

According to data from CoinGlass, more than $650 million leveraged crypto positions have been liquidated over the last 24 hours, with $455 million representing long liquidations.

Related: BitMine adds over 200K ETH in ‘aggressive’ post-crash weekend buying

Long Ether liquidations amounted to $114.5 million, with the tally continuing at the time of publication.

This means that long traders were caught off guard by Ether’s drop to below $4,000. The largest single liquidation order occurred on the OKX crypto exchange involving an ETH/USD pair worth $5.5 million.

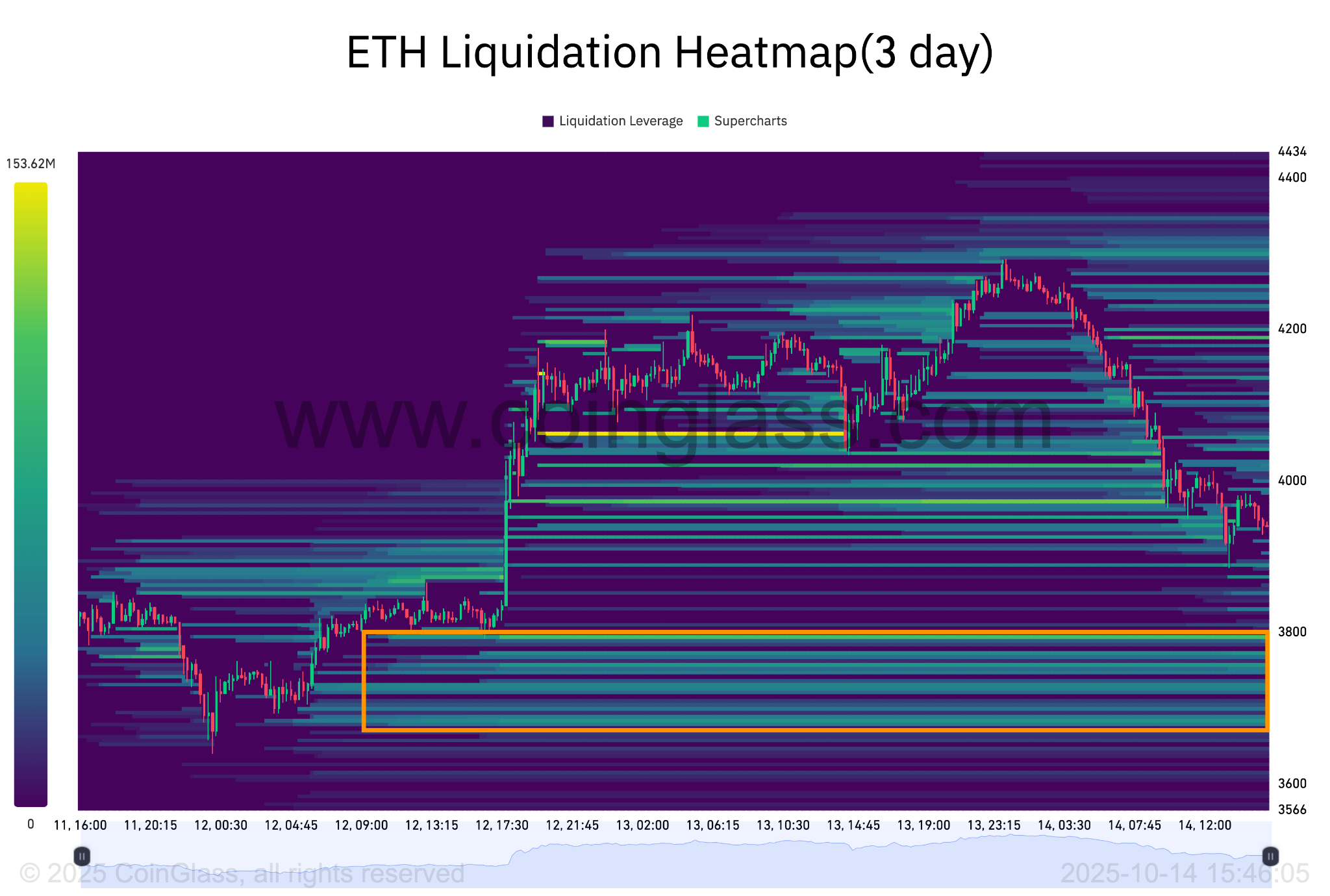

The CoinGlass liquidation heatmap showed several bands of buyer interest below the spot price, with bid orders worth over $743 million sitting between $3,670 and $3,800. This suggested that the ongoing correction might be capped at this level.

Is Ether’s uptrend over?

Market analysts suggest that the ETH price is undergoing a technical correction to retest key support levels before resuming its uptrend.

MN Capital founder Michael van de Poppe said that Sunday’s drop saw the ETH/BTC pair plunge to 0.032, which was an “ideal zone for buys.”

“$ETH hit the ideal zone for buys and I think it’s ready for a trend switch,” van de Poppe wrote in a Tuesday X post, adding:

“It needs a higher low and then we’re off toward new highs.”

Fellow analyst Daan Crypto Trades said while the 0.032 level has “held nicely,” the ETH/BTC pair needs to break above 0.041 to continue the uptrend.

Analyzing the ETH/USD pair, Titan of Crypto said the relative strength index, or RSI, had broken out of a multi-year downtrend, suggesting a massive breakout was imminent.

If the fractal plays out as seen in July 2020, Ether’s price could continue its uptrend with the upside target set between $8,000 and $10,300, based on Fibonacci levels.

“#ETH breakout is loading.”

#ETH breakout is loading…

And it could melt faces pic.twitter.com/PPT2MXHd4H

— Titan of Crypto (@Washigorira) October 13, 2025

Ether’s downside may be capped at $3,800, according to pseudonymous analyst Chimp of the North.

The analyst shared a chart suggesting that the altcoin could continue its retracement to retest the $3,800 support before launching another rally toward the $5,000 and above.

As Cointelegraph reported, ETH could return to $4,500 over the next few days after the Ethereum futures markets stabilized from Friday’s crypto flash crash.

Ether’s bull flag targets $10,000

From a technical perspective, ETH price is still trading within a bull flag pattern in the weekly time frame, a bullish setup that forms after the price consolidates inside a down-sloping range following a sharp price rise.

Ether is now retesting the lower boundary of the flag, currently at $3,870, which is acting as immediate support.

The bull flag will resolve once the price breaks above the upper trendline at $4,440, opening the path for the continuation of the uptrend toward the technical target of the bull flag at $10,050 — up 164% from the current price.

Conversely, the RSI has dropped to 54 from 74 over the last seven weeks, suggesting that the ongoing correction may go on for longer as profit-taking continues.

A daily candlestick close below the support level at $3,800 will put Ether’s price at risk of dropping first to the 20-week SMA at $3,700 and later to $3,500.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.