Zeta Network Raises $230M in Bitcoin-Backed Private Sale

Zeta Network Group said on Wednesday that it raised about $230.8 million through a private share sale, with investors paying in Bitcoin (BTC) or SolvBTC — a wrapped Bitcoin-backed token issued by Solv Protocol.

Under the deal, investors will receive newly issued Class A ordinary shares and warrants allowing them to buy additional shares later at $2.55 each. Each share and warrant pair was sold at a combined price of $1.70.

According to Zeta, the arrangement will strengthen its balance sheet with Bitcoin-based assets as part of a broader treasury strategy. “By integrating SolvBTC into our treasury, we’re enhancing financial resilience with an instrument that combines Bitcoin’s scarcity with sustainable yield,” said Patrick Ngan, Zeta Network’s chief investment officer.

Zeta Network, a digital infrastructure and fintech company developing an institutional Bitcoin platform, expects the deal to finalize on Thursday, pending closing requirements.

Solv Protocol is an onchain Bitcoin asset management platform that issues SolvBTC, a 1:1 wrapped Bitcoin-backed token designed for institutional use in yield and liquidity strategies.

Ryan Chow, the CEO of Solv Protocol, said that “listed entities are redefining what it means to hold Bitcoin productively.”

https://www.youtube.com/watch?v=NpzQD7tSqMg

Related: Solv brings RWA-backed Bitcoin yield to Avalanche blockchain

Bitcoin yield strategies emerge

While Bitcoin remains the primary asset for digital asset treasuries (DATs) — a strategy popularized by Michael Saylor in 2020 — some debate has emerged over whether proof-of-stake networks like Ethereum (ETH) or Solana (SOL), which generate yield for validators, could offer a more attractive long-term return profile.

In the meantime, companies are finding ways to put Bitcoin to work.

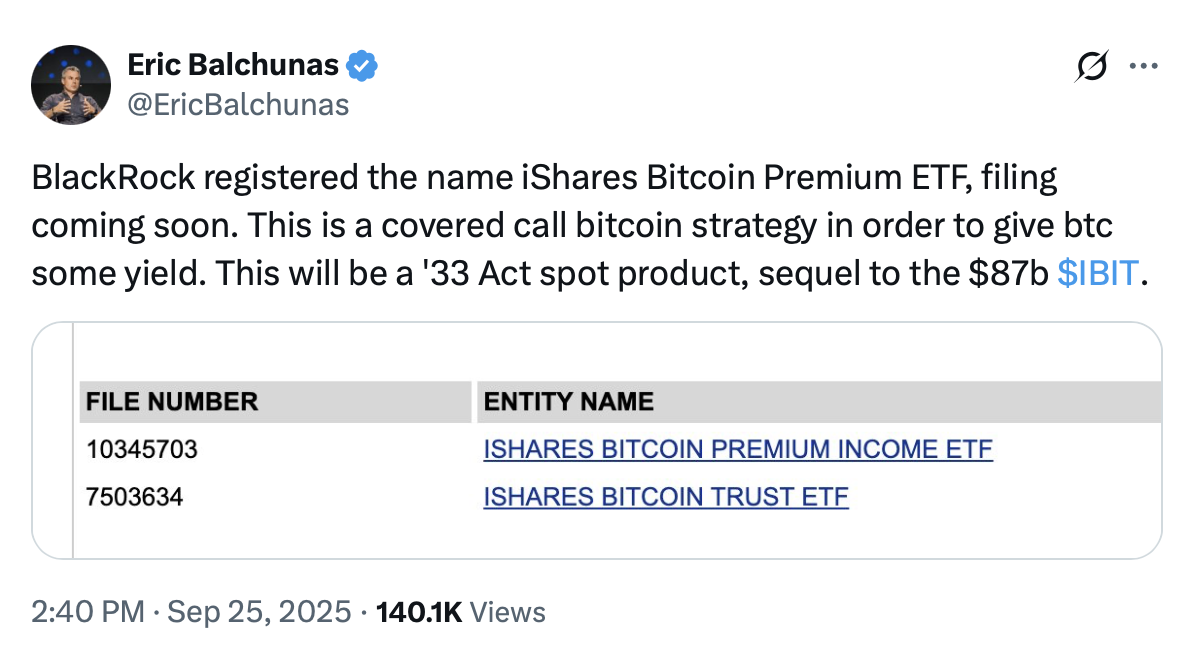

On Sept. 25, the world’s largest asset manager, BlackRock, filed to register a Delaware trust company for a Bitcoin Premium Income ETF. Bloomberg ETF analyst Eric Balchunas said the proposed fund would generate yield by writing covered call options on Bitcoin futures and collecting the option premiums.

Coinbase launched a Bitcoin Yield Fund in May, giving institutional investors outside the US exposure to yield on BTC holdings. The fund aims to generate an annual net return of 4% to 8% for holders.

Speaking at the Token2049 event this year, Chow said Bitcoin could be staked to secure networks. In the future, he expects thousands of Bitcoin to enter proof-of-stake ecosystems like Solana.

Magazine: Pakistan will deploy Bitcoin reserve in DeFi for yield, says Bilal Bin Saqib