Crypto, fintech Groups Urge CFPB to Defend Open Banking Rule

A coalition of fintech, crypto and retail industry trade groups is urging the US Consumer Financial Protection Bureau (CFPB) to adopt a robust open banking rule that safeguards consumers’ control over their financial data.

The letter shared with Cointelegraph was signed by leading crypto advocacy groups — including the Blockchain Association and the Crypto Council for Innovation — alongside fintech and industry organizations such as the Financial Technology Association, American Fintech Council and others representing retailers and small businesses.

The letter responds to the CFPB’s review of the Personal Financial Data Rights Rule under Section 1033 of the Dodd-Frank Act, which will define how consumers share their financial data with third-party services.

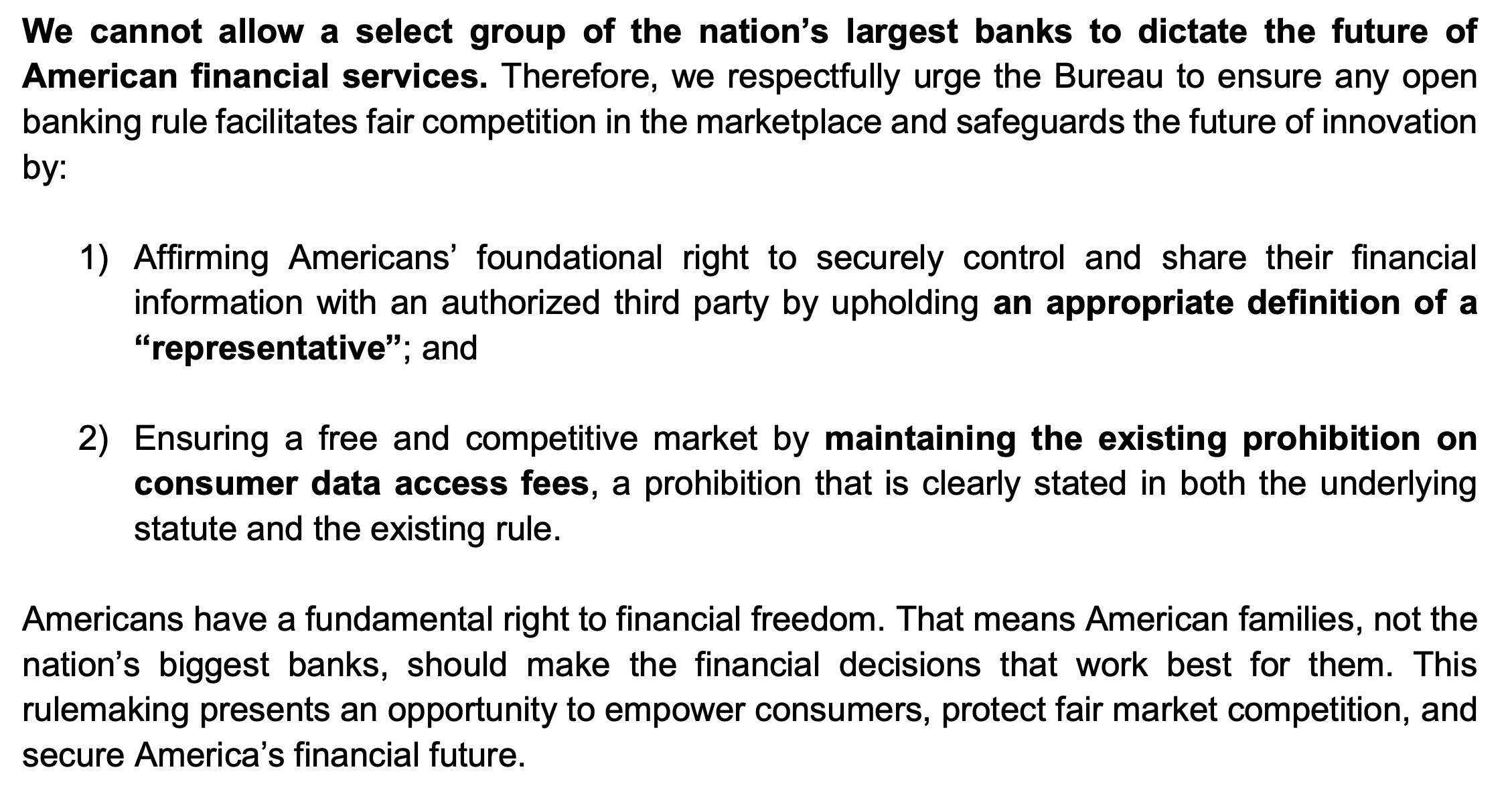

The coalition said it supports clear consumer data rights and urged the CFPB to finalize an open banking rule that affirms Americans own their financial data, not big banks. The groups said consumers should be free to share that data with any authorized third party, not just fiduciaries.

The group also pressed the CFPB to preserve the current ban on data access fees, saying the rule must uphold a free and competitive market and that the prohibition is already clearly established in law.

Open banking was first proposed in the US during the administration of former President Joe Biden in 2022 and finalized on Oct. 22, 2024.

The framework allows consumers to securely share financial data with third-party apps through APIs (application programming interfaces), forming a critical bridge between traditional finance and sectors such as decentralized finance (DeFi) platforms, crypto on-ramps, and digital banking tools.

The letter claims that open banking is relied upon by “over 100 million Americans” to access tools like investment platforms, crypto wallets, and digital payment apps to manage their finances and run businesses.

“Yet these rights are under attack,” the letter says. “The nation’s largest banks want to roll back open banking, weaken consumer financial data sharing, and crush competition to protect their position in the marketplace.

Related: US shutdown enters third week as Senate Democrats plan crypto roundtable

Banks push back on open banking

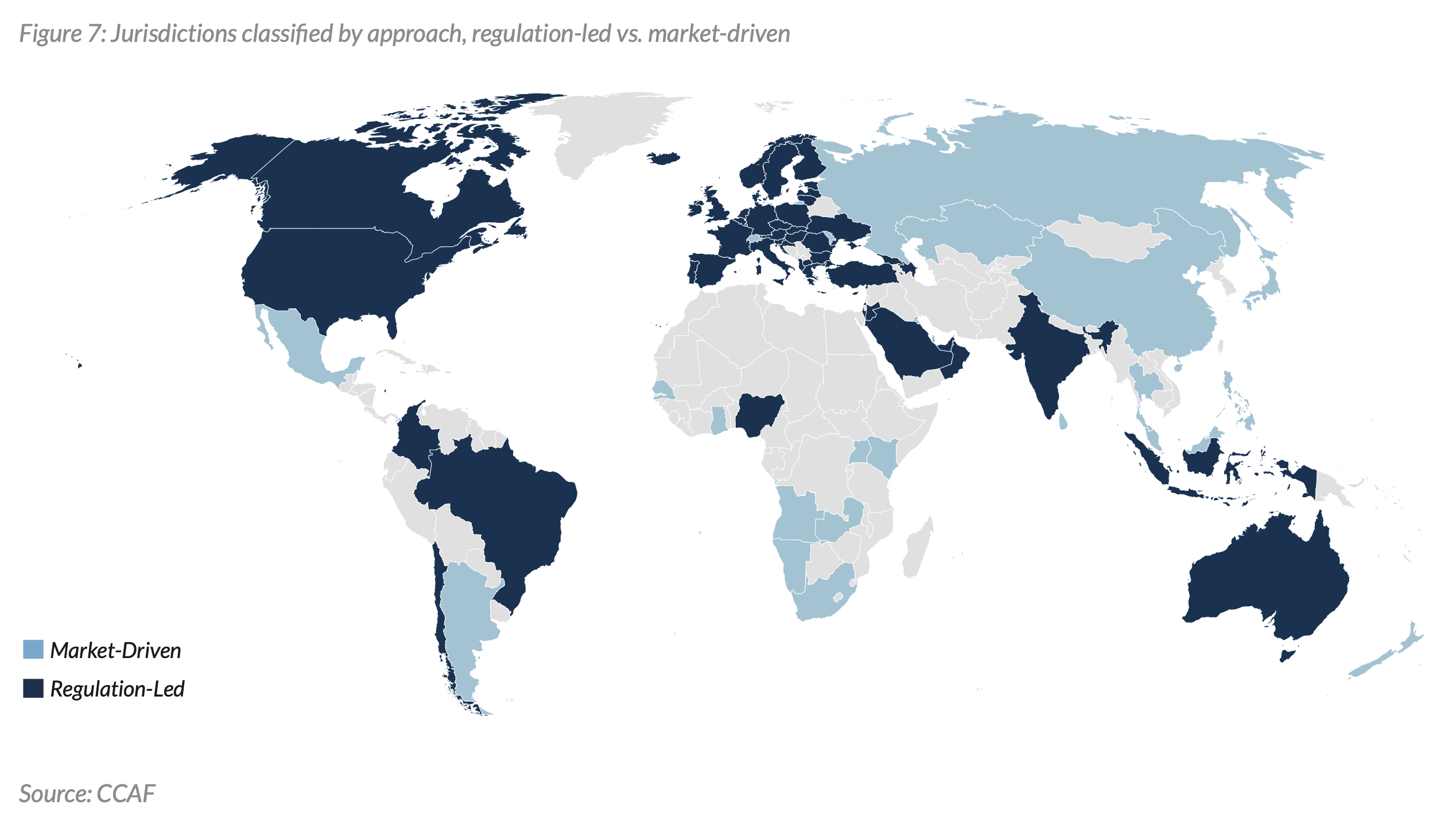

While open banking already exists in the European Union, the UK, Brazil and several other countries, there has been pushback against the rule in the US from major banks.

The same day the rule was finalized in Oct. 2024, the Bank Policy Institute, a trade group representing major banks like Wells Fargo, Bank of America and JPMorgan Chase, sued to block it, arguing that it posed security risks and unfairly burdened incumbents.

On July 11, a Bloomberg report revealed that JPMorgan intended to begin charging fintech companies for access to their customers’ banking data.

Crypto industry steps up pressure on Washington

Tuesday’s letter builds on an earlier appeal the coalition sent to US President Donald Trump on July 23, accusing US banks of stifling innovation by suing to delay open banking reforms and introducing data-access fees for fintech and crypto platforms.

On Aug. 14, more than 80 executives from the crypto and fintech sectors signed a letter calling on the President to prevent banks from imposing fees on companies that access customer financial data.

On Monday, Gemini co-founder Tyler Winklevoss wrote on X: “Banks want to gut the Open Banking Rule (1033) so they can tax and control your financial data and remove your freedom to choose the services you want. This is bad for crypto and financial innovation in America.”

Tomorrow is the last day to submit a comment letter to the CFPB regarding its proposed open banking rule.

Magazine: EU’s privacy-killing Chat Control bill delayed — but fight isn’t over