DRAM supercycle 2017: how previous memory crisis unfolded

The memory market is turning up again: inventories are low, manufacturers are prioritizing HBM for AI, and analysts are predicting a new DRAM supercycle with increasing prices until at least 2027.

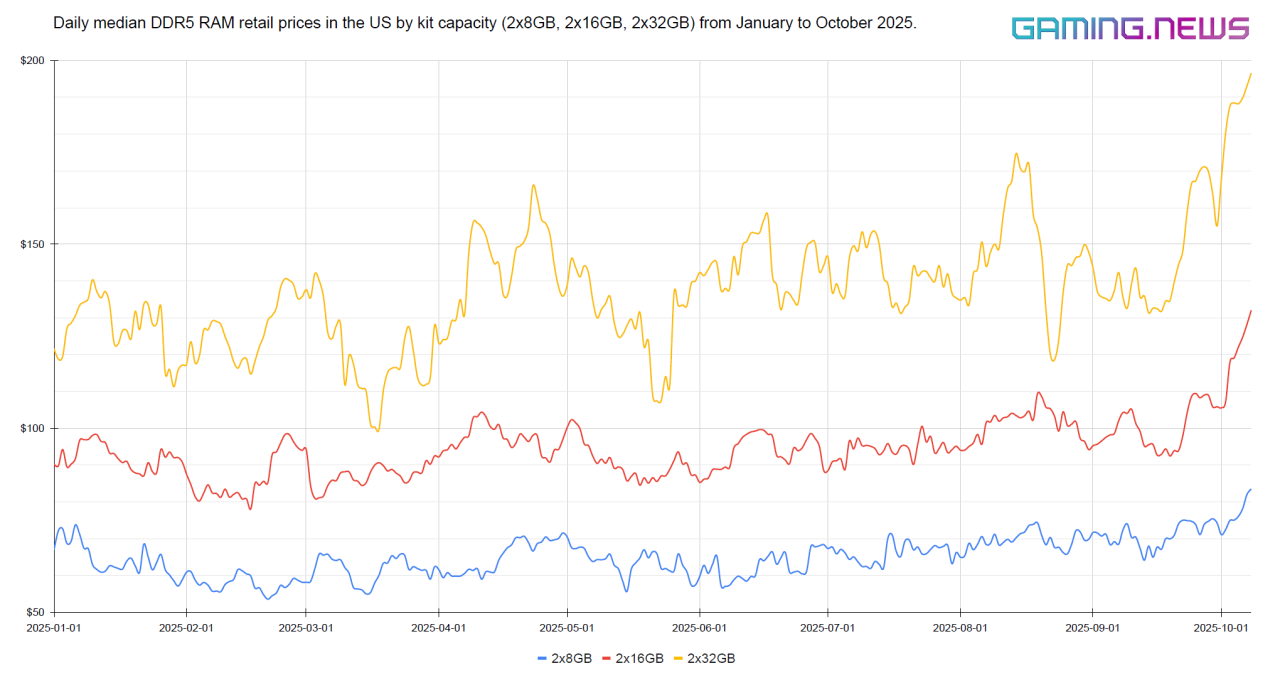

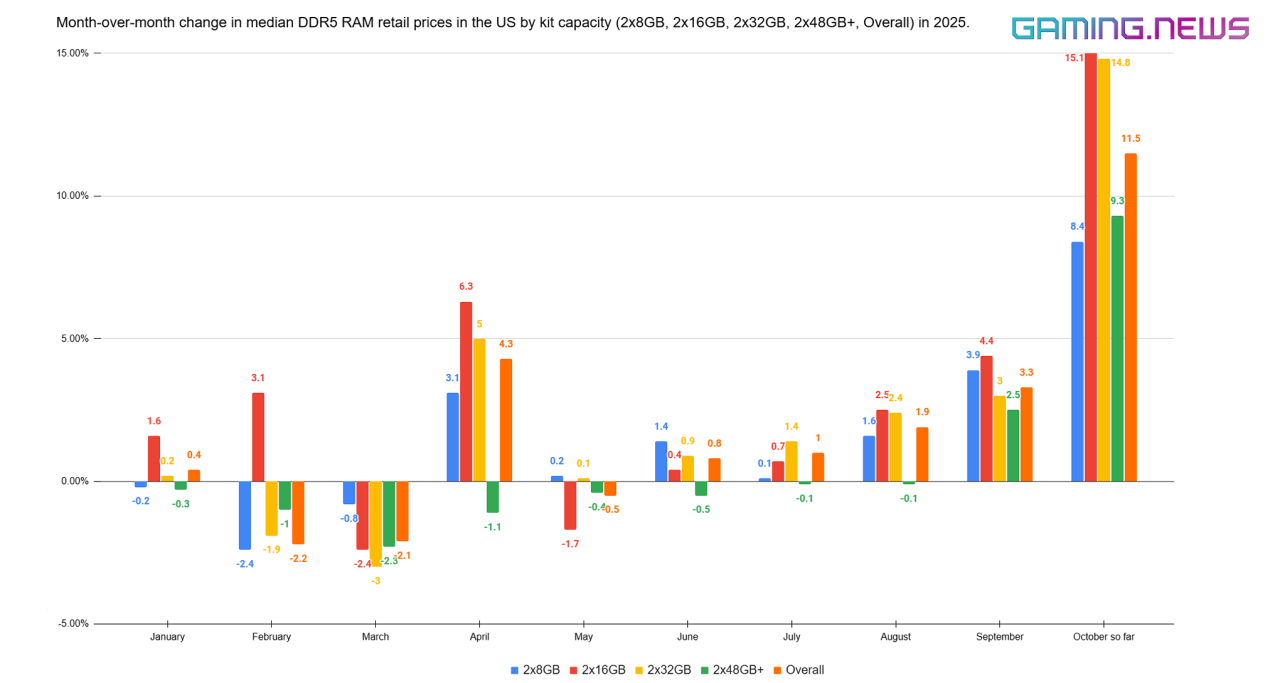

Consumers are already seeing this in the rising costs of RAM: good discounts are offered less often, some popular models are out of stock, and retail prices on most 2x16GB and 2x32GB DDR5 kits are up by 15-30% in just a few weeks.

This isn’t the first time the memory market has looked like this. In 2017-2018, demand from smartphones and data centers accelerated. Average smartphone memory moved toward 3.2 GB per device (initial forecast was 3.7 GB) because of high-end devices with 4 GB and 6 GB of mobile DRAM.

Suppliers kept capacity and capex tight, and DRAM prices and manufacturers’ revenues climbed quarter after quarter, until inventories were full due to lowered demand by late Q4 2018 (data centers had been built). Contract prices turned down, setting up a broad fall of consumer prices through 2019.

PC builders and gamers felt it directly: upgrades were postponed or scaled back as retail kit prices spiked during 2017-18, the press covered rising prices, and Reddit and other forums were full of angry threads and comments.

In this article, we break down what triggered the 2017-2019 DRAM supercycle, how it played out, who benefited, and what ended it. Since the same processes are happening today again, consumers should be aware that DDR5 RAM prices are on an upward spiral, and this trend is not just a temporary increase before Black Friday.

What Is a DRAM Supercycle?

A DRAM supercycle is a period of several quarters where demand for memory exceeds supply, causing prices to continue climbing. It isn’t a single hike or simple seasonal increase; it lasts long enough to lift wholesale contract deals, spot quotes, and, eventually, the shelf prices you pay (and it has already started reaching retail).

The engine represents a structural shift, characterized by increased RAM per consumer device, significant data center build-outs, or, in the current cycle, AI build-outs, all of which are encountering slow, deliberate supply.

DRAM capacity can’t be added instantly, as suppliers pace new lines and process nodes, resulting in an imbalance that persists and keeps pricing firm.

It may seem like far-off tech details, but it ultimately affects the consumer’s wallet. In a supercycle, PC RAM kits become pricier for an extended period of time and go on sale less often, while laptop makers trim memory on mid-range models to hold costs. And mobile devices and other tech could be hit, too.

We’ve seen this before in 2017. Today’s setup (almost empty inventories and factories giving priority to AI) looks familiar, and analysts expect the upturn to run through 2027.

Previous DRAM Supercycle, Timeline

Setup, Q4 2016

- DRAM stock runs thin, causing supply to fall behind demand, which in turn ends the prolonged price slump.

- Shelf prices begin to tick up.

- Chipmakers stay cautious with factory spend and new capacity, keeping output tight.

Surge, 2017

- Prices climb quarter after quarter in both contract deals and spot quotes.

- Samsung and SK hynix report record memory revenue; margins widen across the board.

- The PC market is transitioning from DDR3 to DDR4, which is tightening the same pools of supply.

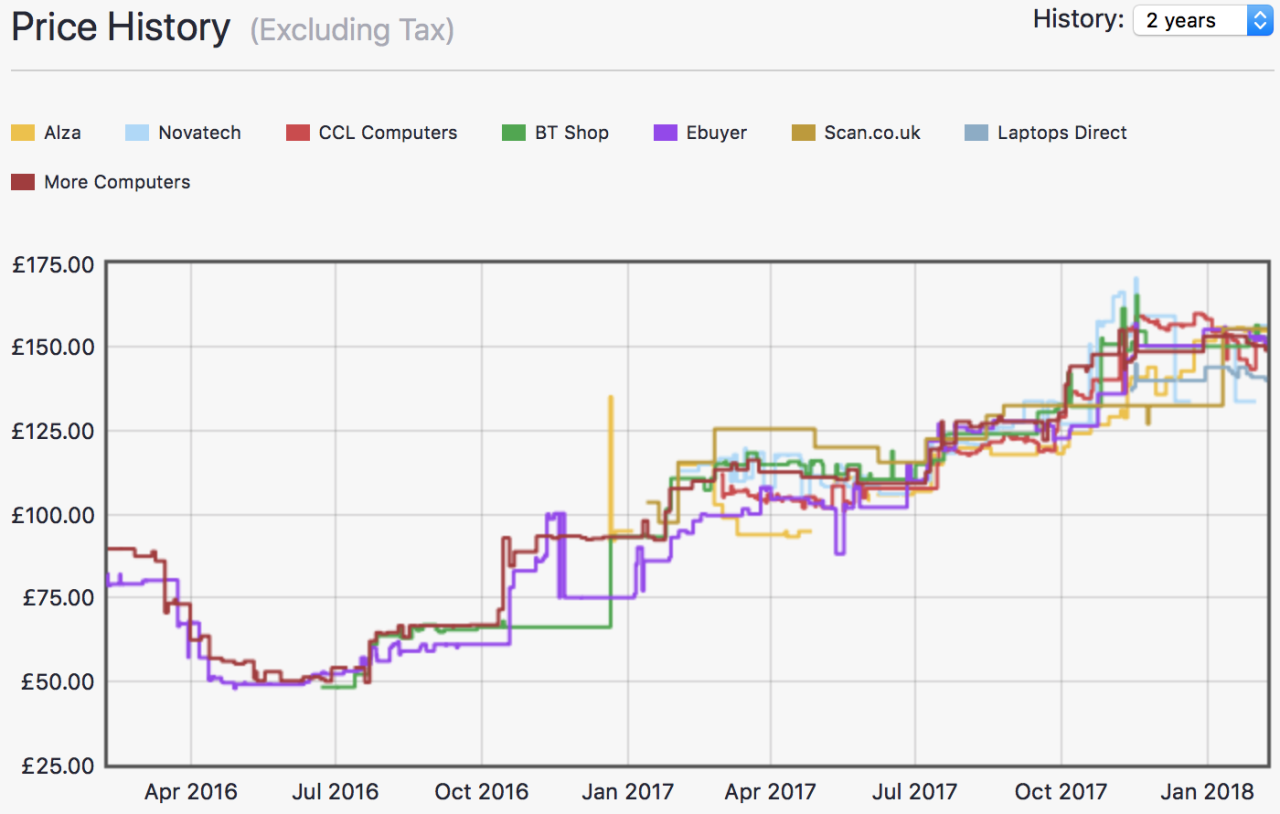

- At retail, RAM kits saw a price increase of about 40-60%, accompanied by fewer options and discounts.

Peak, H1 2018

- Server demand for memory remains high, and phones continue to add more RAM per device.

- Graphics memory gets squeezed by crypto mining, which spills pressure onto the rest of DRAM.

- Average selling prices hit multi-year highs, another 30-50% increase in retail.

- First pushback appears: some laptop and phone makers trim RAM configs to keep costs in check.

Pivot, H2 2018

- Inventory builds up through the channel, OEMs and resellers are holding more weeks’ worth of stock.

- Contract talks slow, and the first signs of softening appear; spot prices for some parts start slipping.

- Buyers gain leverage, signaling that the upcycle has topped out, retail RAM prices are down by 30-50%.

Correction, 2019

- Prices fall steadily across most DRAM categories as excess stock clears.

- Vendors are reducing capex and slowing process migrations to prevent market oversaturation.

- Retail RAM becomes cheaper (another 30-40% decrease in price) and easier to find again, with kit availability improving.

- By year’s end, the market will return to balance and the supercycle will be over.

What Triggered DRAM Supercycle

By late 2016, DRAM supply was already tight. Phones were packing more memory per device (roughly 2.4 GB to 3.2 GB in a year), and the major cloud providers have begun constructing new data centers and adding servers at a pace. Demand was rising on all fronts: the latest generation of mobiles, data centers, and the usual PC market.

The PC market was in the middle of a generational RAM shift (just like nowadays). OEMs and upgraders were moving from DDR3 to DDR4 RAM across desktops and laptops, which added additional pressure on already tight DRAM reserves.

On the other side, the big three memory manufacturers (Samsung, SK hynix, and Micron) kept a cap on spending and didn’t rush new capacity online. This makes sense, because capacity can’t be added overnight, building and ramping lines takes time. At the same time, adding too much will result in overproduction, layoffs, and idle plants when demand eventually cools off.

Manufacturers funneled their resources into higher-margin lines: server DRAM, LPDDR for phones, and graphics memory. Then crypto hit, pushing up demand for GDDR and tightening the screws on the rest of the memory stack.

Consumer RAM sticks were never top of the queue, but everyone could feel it directly at the time. Desktop and laptop RAM became increasingly difficult to find at steady prices, and the good deals thinned out even before shortages and rising prices became the headline.

All the pieces together: fast-rising demand, rationed supply, and lean inventories; by early 2017, the market was primed for a memory upcycle.

Retail Impact: PC RAM Prices are surging

Through 2017 and early 2018, DRAM hikes continued every quarter, and it became tangible in retail. DDR4 RAM 2x8GB kits that cost $70-90 in late 2016 or early 2017 were routinely $150-200 a year later, and the high-clock bins weren’t a sensible choice for most PCs.

PC builders and gamers reacted the only way they could: upgrades were pushed back, angry threads about rising RAM prices were posted, 32 GB moved into premium-only territory again, and many stuck with 8-16 GB to stay on budget.

It didn’t stop at home-built rigs; the squeeze ran through factory lines, too. Mid-range laptops quietly shipped revisions with less RAM, often landing on 8-12 GB or moving to soldered LPDDR to trim the bill of materials. Phone makers slowed the year-to-year RAM bumps, and prebuilts (especially small-form-factor) shipped leaner or with single-stick layouts that looked fine on a spec sheet but cut real bandwidth.

The pattern was straightforward: the cost per gig increased significantly. Consumers either paid more to keep the same amount of memory, or they got less for the same money, with shorter sale windows and fewer easy upgrade paths, thanks to soldered modules and one-slot designs.

How DRAM Supercycle Ended

By H2 2018, the market had shifted once again. OEMs and channel partners were holding onto growing inventories, with weeks of unsold DRAM stock accumulating. Contract prices began to fall as suppliers faced lower demand and pushback from buyers. The supercycle had peaked, and demand could no longer absorb the available supply at elevated price points.

2019 was the comedown. Retail RAM prices eased month after month, which made headlines, stock came back to shelves, and the once premium high clock DDR4 RAM 16GB or 32 GB kits dropped to sane levels again. Appealing deals lasted longer, and consumers didn’t have to stalk restocks to finish a new PC build.

On the supply side, manufacturers put the brakes on. Micron and others cut factory spending and slowed new process ramps to curb bit growth (the pace at which total memory capacity shipped increases). Less fresh output enables the channel to clear leftover inventory rather than accumulating more. By year’s end, most of the excess was gone, and the market was roughly back in balance.

Who Benefited, Who Paid

Memory manufacturers enormously profited from the DRAM supercycle. Samsung, SK hynix, and Micron reported record quarter gains through 2017 and 2018, while holding back on new capacity. They also moved more wafers to higher-value lines (memory for data centers/servers, mostly). That left less headroom for mainstream PC parts, which in turn added additional bit of pressure on prices across the board.

Everyone else lost, or at most stayed at net zero. DRAM prices nearly tripled. Some OEM builders had to hold prices despite spending more on memory, simply because their products would not be bought at all otherwise. As for consumers, retail PC RAM often ran at roughly double 2016 or early 2017 prices, big promos dried up, and many had to spend more or cut plans and wait it out to add brand new RAM to their rigs.

Laptop and phone vendors trimmed memory in mid-range models to keep costs in check. In practice, consumers either paid more to keep the same amount of RAM, or they accepted a smaller configuration for the same money.

Legal and Regulatory Response

In the US, class-action lawsuits were filed in spring 2018, accusing Samsung, SK hynix, and Micron of price fixing during the DRAM upcycle. A federal judge dismissed the claims in 2019, ruling that the plaintiffs failed to show actual collusion beyond parallel pricing behavior. The Ninth Circuit upheld that decision in 2022, and no compensation was awarded to consumers.

In mid-2018, China’s antitrust agency launched an investigation into DRAM pricing. Nothing ever came of it publicly to this day: no report, no fines, and no follow-up. Still, it was a signal that Beijing wasn’t satisfied with this situation, just like everyone else.

At the same time, a local court in Fuzhou imposed a temporary sales ban on Micron during a patent dispute with Taiwanese chipmaker UMC and China’s Jinhua. That case dragged on quietly for years and eventually ended in settlements. No one really won, but chip manufacturing and pricing clearly became a political issue as well.

DRAM Market Takeaways

A supercycle isn’t powered by demand spikes alone. The 2017-2019 cycle happened because demand continued to rise and suppliers maintained tight control over supply. The major memory chipmakers held down factory spending (capex), spaced out process upgrades, and steered more wafers into higher-margin lines.

The main sign that it was ending wasn’t a headline price dip but inventory piling up. The “weeks of supply” statistic (how many weeks current stock can cover at normal sales) started climbing, and that proved a better signal than day-to-day spot quotes.

DRAM is one connected market. A shortage in HBM or server chips pulls capacity from consumer DIMMs and pushes up PC RAM prices. The key takeaway is to monitor supplier behavior as closely as end-market demand.

Why This Matters Now: DDR5 RAM Prices

Today’s market shows many of the same signs as the last supercycle. AI hardware and HBM are absorbing advanced capacity, leaving less room for PC RAM. Inventories are near multi-year lows, and memory makers started hiking prices again.

According to our research, the impact is already visible even in consumer DDR5 RAM prices, with montly median increases of 15% 10 days ago and up to 30% now, less than in a month.

Most analysts expect this upturn to run through 2026 and peak in 2027, much like the 2017-2018 DRAM supercycle. Put simply, when memory inventories remain lean and capacity is directed toward enterprise, consumer RAM becomes more expensive.

If those conditions hold, you need to expect higher PC RAM costs well into 2026 across the ecosystem.

Editor’s note

We will continue to follow developments in AI-hardware deals and track statements from analysts and memory manufacturers (for now, public statements have come from Adata and Micron). Latest deals include:

We are also launching price trackers for RAM and SSD this week, which will be updated regularly, with additional categories to follow later. Expect weekly news roundups covering the trends in consumer hardware pricing and retail availability.

This topic is heavily underreported, leaving consumers without a clear view of the actual trends (it’s not just a single price hike before deep discounts).