Crypto Funding Slows, but RWA, Stablecoin Startups Draw Capital

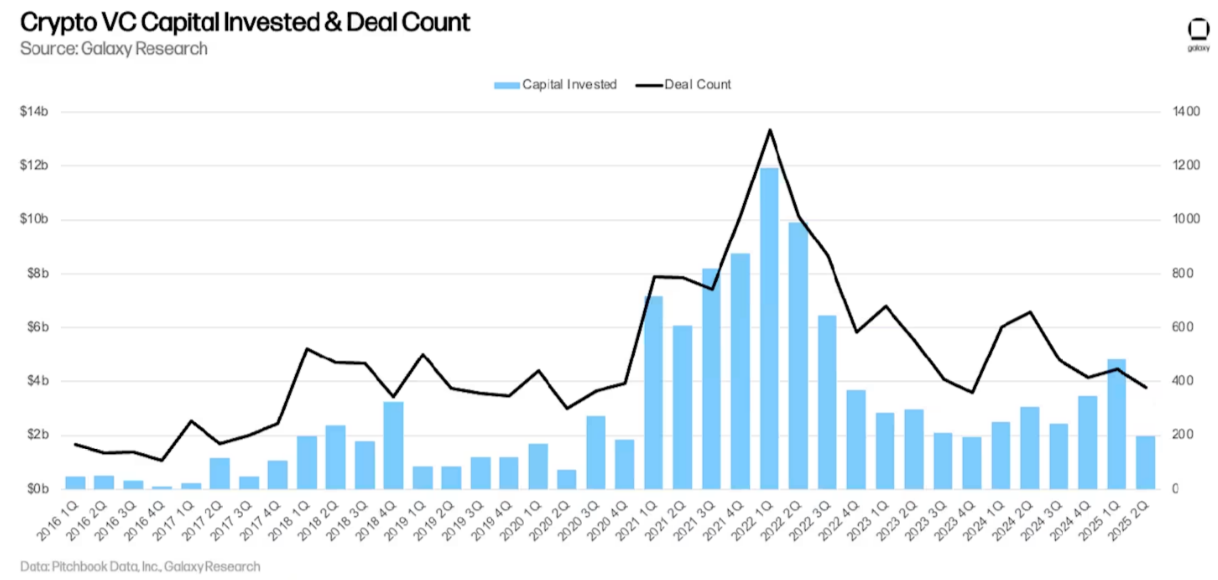

Although digital assets continue to attract record interest from institutional investors, traditional banks and corporations, venture capital activity in the sector has slowed notably since the first quarter.

Galaxy Research’s latest VC report showed that crypto and blockchain startups raised a total of $1.97 billion across 378 deals in the second quarter. That represents a 59% decline in funding and a 15% drop in deal count compared to the previous quarter. According to Galaxy, it was the second-lowest quarterly total since Q4 2020.

Researchers observed that the long-term correlation between Bitcoin’s (BTC) price and venture capital investment in the sector has broken down and is “struggling to recover.”

According to Galaxy, this disconnect stems from a combination of waning interest among venture capitalists and market narratives that increasingly prioritize Bitcoin accumulation over other investments.

Meanwhile, data from Insights4VC suggests a shift in capital flows. Digital asset treasury companies — vehicles raising funds primarily to purchase cryptocurrencies — have attracted the lion’s share of investment this year, pulling in $15 billion through Aug. 21 to build their holdings of Bitcoin, Ether (ETH) and other tokens.

The divergence between treasuries accumulating crypto and startups seeking venture funding reflects a changing investor mindset. More backers are demanding clearer paths to revenue and sustainable business models, according to Hunter Horsley, CEO of Bitwise, a crypto exchange-traded fund provider.

Against this backdrop, this month’s VC Roundup examines some of the most notable funding rounds in onchain finance, real-world assets (RWAs) and stablecoin infrastructure.

Related: VC Roundup: VCs fuel energy tokenization, AI datachains, programmable credit

Mavryk raises $10 million to advance institutional RWA tokenization

Layer-1 blockchain Mavryk Network has secured $10 million in new funding in a round led by Multibank Group, as it works to expand institutional access to tokenized RWAs.

The investment forms part of a broader partnership between Mavryk and Multibank aimed at tokenizing more than $10 billion worth of properties in the United Arab Emirates — one of the largest RWA tokenization initiatives globally.

This latest raise follows Mavryk’s $5 million funding round earlier this year, which included backing from Ghaf Capital, Big Brain, MetaVest Capital, Collective Ventures and others, as reported by Cointelegraph’s VC Roundup.

Related: Dubai won the real estate tokenization play

Grvt closes $19 million Series A round

Grvt, a hybrid cryptocurrency exchange focused on privacy-preserving onchain finance, has raised $19 million in a Series A round co-led by ZKsync, Further Ventures and EigenCloud, among others.

Built on ZKsync technology, Grvt is developing privacy-focused infrastructure for onchain investment and trading. The company said the capital will support the expansion of its product suite, including crosschain applications, options markets and RWAs.

Grvt has recently seen growing trading activity, processing over $922 million in perpetual futures volume in the past 24 hours, according to DefiLlama.

Stablecore secures $20 million to help banks, credit unions adopt stablecoins

Stablecore, a stablecoin infrastructure platform serving credit unions and regional banks, has raised $20 million in a seed round led by Norwest, with participation from Coinbase Ventures, Crql, BankTech Ventures and others.

The company is developing a “digital asset core” platform designed to integrate various components of cryptocurrency services, enabling smaller financial institutions to more easily accept, manage and deploy stablecoins.

Stablecore cited the recent passage of the US GENIUS Act marks a major step forward for the industry and could accelerate stablecoin adoption among traditional financial institutions.

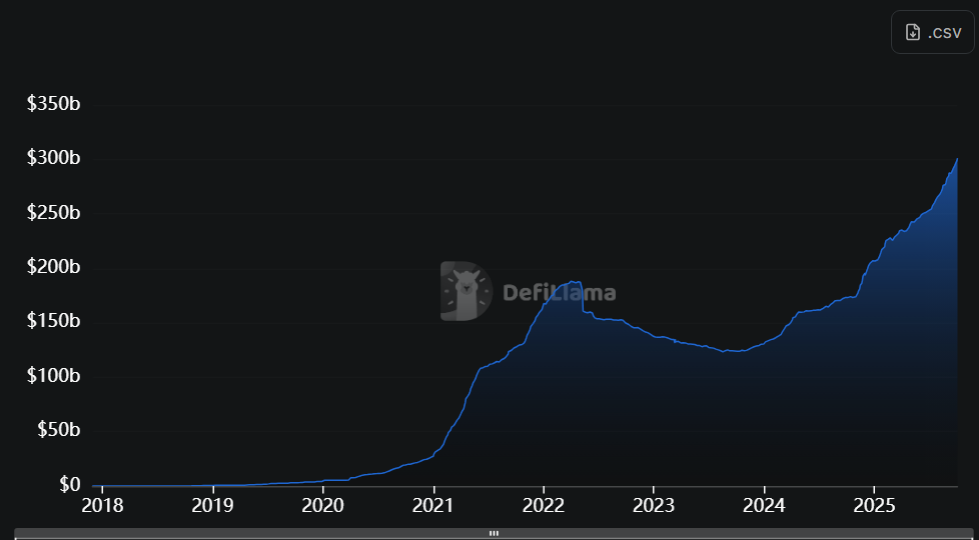

The raise comes as the total stablecoin market capitalization surpassed $300 billion for the first time, underscoring growing interest in the sector.

Related: Synthetic tokens see a comeback as stablecoins market cap climbs

Plural raises over $7 million to build ‘electron economy’ for real-world energy assets

Plural, a financial infrastructure platform bridging real-world energy assets with digital markets, has raised $7.13 million in a seed round led by Paradigm, with participation from Maven11, Volt Capital and Neoclassic Capital.

The company leverages tokenization and smart contracts to give investors access to high-yield energy assets such as solar farms, battery storage systems and data centers. Plural says more than $300 million in distributed solar and battery assets are currently available for investment on its platform.

The funding comes as global electricity demand from data centers surges, driven by the expansion of AI and cloud infrastructure, intensifying the need for renewable and decentralized energy sources beyond the traditional power grid.

Magazine: Thailand’s ‘Big Secret’ crypto hack, Chinese developer’s RWA tokens: Asia Express