S&P 500 Is Up 106% Since 2020, But Has Collapsed Against Bitcoin

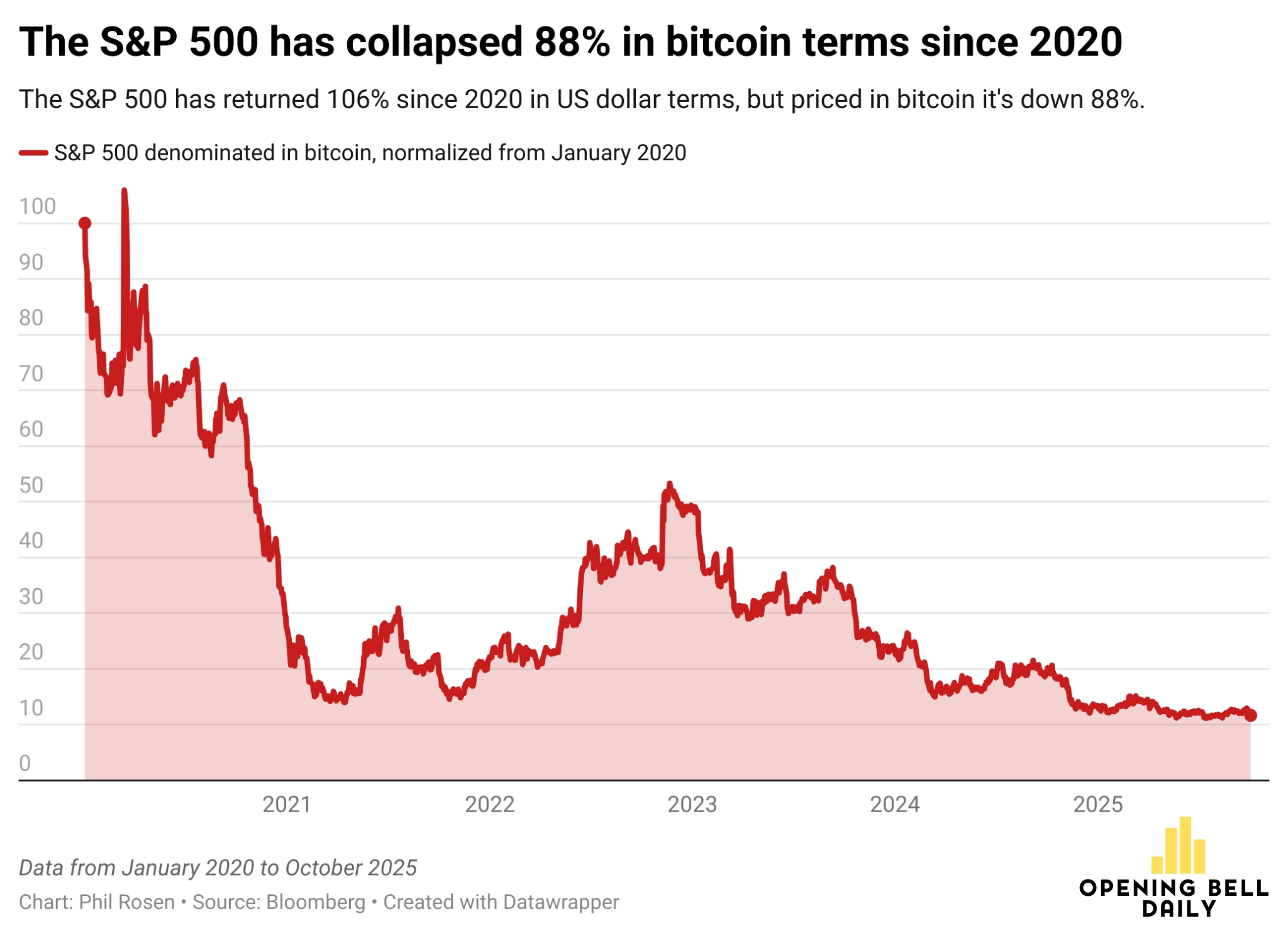

While billionaire hedge fund manager Warren Buffett has long touted investing in the S&P 500, recent data shows that since 2020, the index has underperformed Bitcoin by around 88%.

In an Oct. 5 X post by Phil Rosen, the co-founder of stock market data newsletter Opening Bell Daily, noticed that while the S&P 500 has surged 106% in USD value since 2020, it has “collapsed” significantly in BTC denomination, prompting cheers from Bitcoin pundits.

The Standard and Poor’s 500, or S&P 500, is a stock market index tracking the performance of 500 leading companies listed on stock exchanges in the United States.

Since 1957, the index has delivered an annual inflation-adjusted return of around 6.68%, which is usually higher than the average US inflation rate.

It may be why famous US entrepreneur Warren Buffett has frequently touted the S&P 500 index as the best option for the average investor, and reportedly supports a 90/10 investment strategy — with 90% of a portfolio in the S&P 500, and 10% in short-term US Treasury bonds.

S&P 500 breaks records, but so does Bitcoin

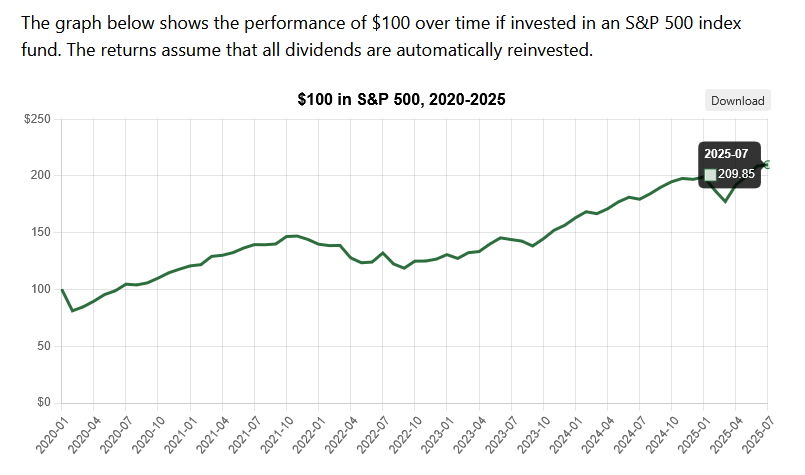

The S&P 500 has continued to break new records in 2025 and is currently at $6,715.79, having risen 14.43% since the start of the year.

Bitcoin, on the other hand, is up 32% on the year after hitting $125,000 for the first time ever on Saturday.

Put another way, according to OfficialData.Org, the return from investing $100 in the S&P 500 from the beginning of 2020 would turn into around $209.85 by July 2025. The same $100 investment in Bitcoin would be worth $1,473.87.

Related: Bitcoin corrects from $125K all-time high: Where will BTC price bottom?

Differences between Bitcoin and S&P 500

However, comparing the two investments isn’t exactly fair.

The S&P 500 is a comprehensive benchmark for the US stock market, representing the performance of the 500 largest publicly traded companies in the country, an index that is constantly updating, and seen as a lower risk and reward investment.

Bitcoin, on the other hand, is a singular digital asset with a completely different set of narratives — centered around scarcity, decentralization and deflation — that has exploded in adoption as investors look for new ways to increase or retain value.

Bitcoin is also relatively new, sees more day-to-day volatility and has a significantly smaller market cap than the S&P 500, at $2.47 trillion compared to a whopping $56.7 trillion.

Magazine: Bitcoin may move ‘very quick’ to $150K, altseason doubts: Hodler’s Digest, Sept. 28 – Oct. 4