Standard Chartered Predicts $1T Bank Outflows to Stablecoins

Multinational bank Standard Chartered predicted that more than $1 trillion could exit emerging market banks and flow into stablecoins by 2028 as demand for US dollar-pegged crypto assets accelerates.

In a Monday report, Standard Chartered’s Global Research department said that it expects global stablecoin adoption to accelerate as payment networks and other core banking activities shift to the non-bank sector.

As stablecoins gain traction in emerging markets (EM), Standard Chartered noted that users might utilize stablecoins to access what’s essentially a US dollar-based account. “Stablecoin ownership has been more prevalent in EM than DM, suggesting that such diversification is also more likely in EM,” Standard Chartered said.

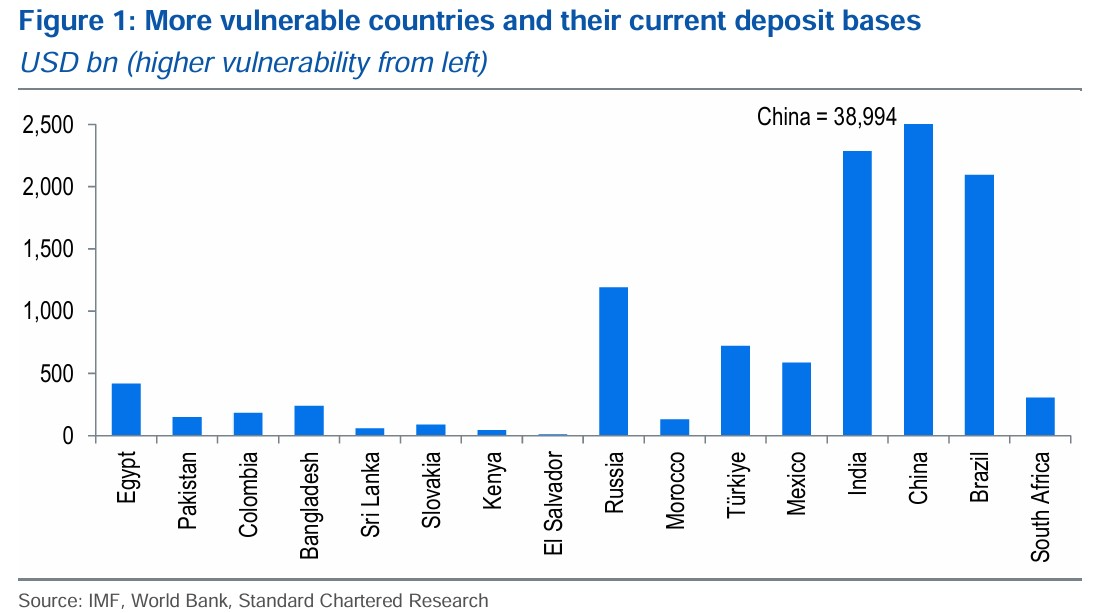

Due to these factors, Standard Chartered predicts that stablecoins used for savings in emerging markets will increase from $173 billion to $1.22 trillion by 2028, implying that roughly $1 trillion could exit emerging market banks within the next three years.

Two-thirds of stablecoin supply already in emerging markets

Standard Chartered said the biggest disruption from stablecoins will likely come from emerging markets, where access to US dollars has historically been limited.

By providing consumers with digital, 24/7 access to a USD account, stablecoins represent lower credit risks than deposits held in their local banks, as the United States’ GENIUS Act requires them to be fully backed by dollars.

Standard Chartered said this dynamic increases the risk of deposit flight from EM banking systems to crypto alternatives.

The bank estimated that roughly two-thirds of the current stablecoin supply is already in savings wallets across emerging markets.

Standard Chartered added that countries with high inflation, weak reserves and large remittance inflows are at risk of deposit flight into stablecoins.

Related: GENIUS Act could mark end of banking rip-off: Multicoin exec

Stablecoins to combat inflation amid failing local currencies

Venezuela is often seen as an example of this shift from banking to stablecoins. With annual inflation between 200% and 300% and the bolivar’s value collapsing, citizens have turned to stablecoins both as a medium of exchange and as a store of value. Merchants now widely denominate prices in USDt (USDT) — often referred to locally as “Binance dollars” — reflecting how stablecoins have supplanted the bolivar in daily commerce amid hyperinflation.

In Chainalysis’ 2024 crypto adoption report, Venezuela ranked 13th and showed a 110% increase in crypto usage throughout the year. Small family stores, large retail chains and shows across the country are accepting crypto through platforms like Binance and Airtm.

In 2023, crypto accounted for 9% of the $5.4 billion in remittances sent to Venezuela.

Beyond Venezuela, countries like Argentina and Brazil are also increasingly substituting savings for USDC (USDC) and USDT to dodge inflation. Many businesses in these countries have started to accept stablecoins as a form of payment.

According to Fireblocks, stablecoins comprise 60% of crypto transactions in both Brazil and Argentina.

Magazine: Hong Kong isn’t the loophole Chinese crypto firms think it is