$11B Bitcoin Whale Returns After 2 Months, Transfers $360M BTC

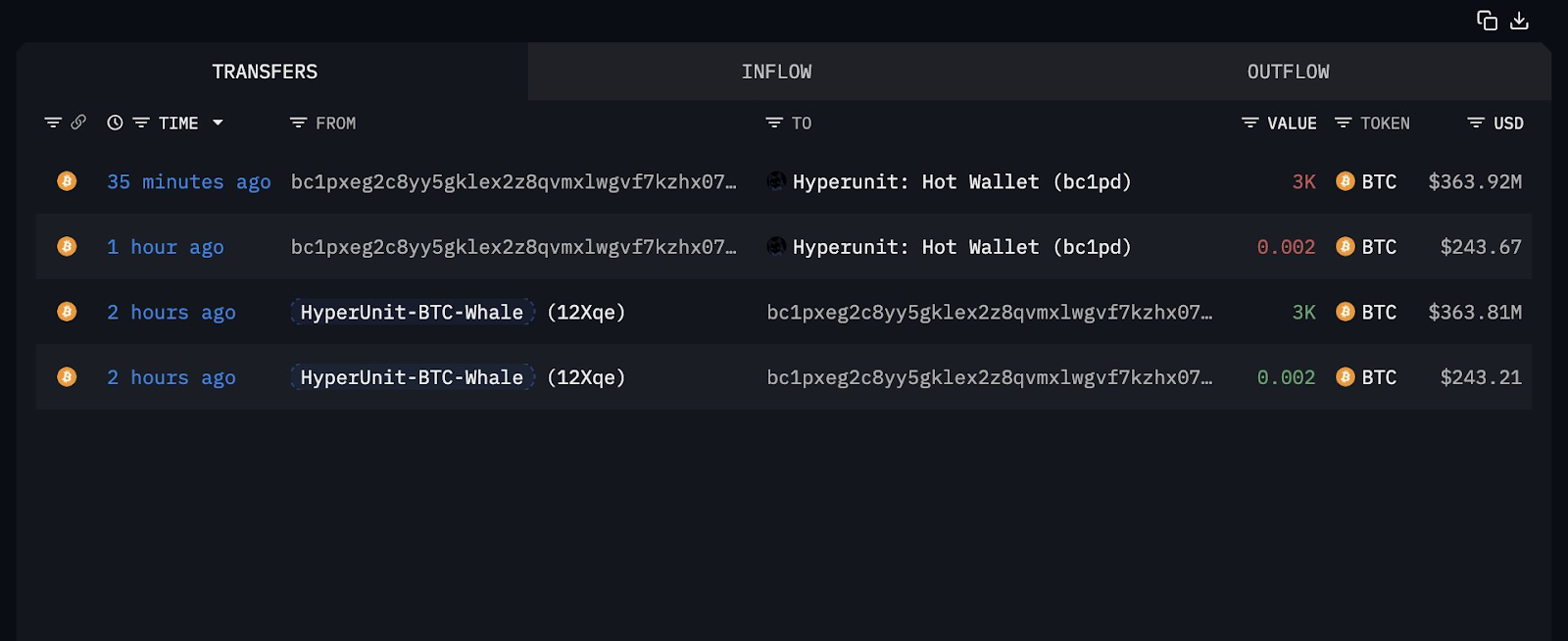

A Bitcoin whale who held around $11 billion in BTC before rotating more than $5 billion of their stash into Ether two months ago has returned to the cryptocurrency market, with another $360 million Bitcoin transfer.

The whale address transferred $360 million worth of Bitcoin (BTC) into decentralized finance (DeFi) protocol Hyperunit’s hot wallet ‘“bc1pd” on Tuesday. This marks their first transfer in two months, according to blockchain data platform Arkham..

The transfer may signal another rotation into Ether (ETH) based on the whale’s transaction patterns.

The $11 billion Bitcoin whale emerged two months ago and rotated around $5 billion worth of BTC into Ether, briefly surpassing the second-largest corporate treasury firm, Sharplink, in terms of total ETH holdings, Cointelegraph reported on Sept. 1.

The whale still held over $5 billion worth of Bitcoin in their main wallet as of Wednesday, signaling more potential selling pressure for the world’s first cryptocurrency.

The Bitcoin whale started rotating their funds into Ether on Aug. 21 when they sold $2.59 billion worth of BTC for a $2.2 billion spot Ether and a $577 million Ether perpetual long position.

The move inspired other large investors, including nine “massive” whale addresses that acquired a cumulative $456 million worth of ETH within a day, shortly after the whale’s initial rotation, Cointelegraph reported on Aug. 27.

Related: $10B in Ethereum awaits exit as validator withdrawals surge

Despite renewed whale activity, Bitcoin continues to attract investors seeking a hedge against rising federal debt and the ongoing US government shutdown, said Ryan Lee, chief analyst at crypto exchange Bitget.

“In this environment, capital is gravitating toward scarce, non-sovereign assets that preserve value over time,” Lee told Cointelegraph. He described Bitcoin’s scarcity and divisibility as key traits that reinforce its role as “digital gold.”

Related: Stablecoin market boom to $300B is ‘rocket fuel’ for crypto rally

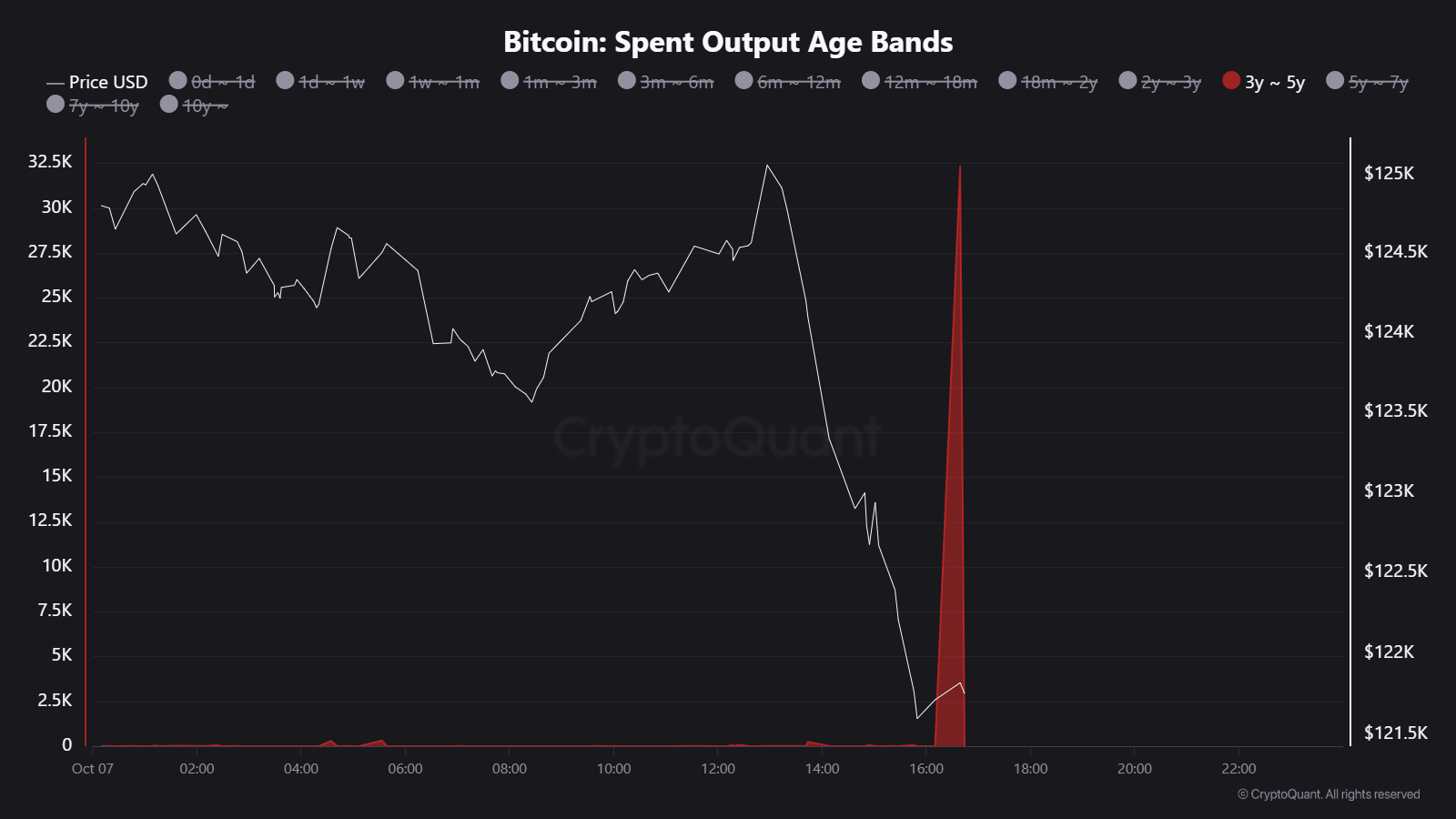

Bitcoin holders transfer $3.9 billion in dormant Bitcoin

Meanwhile, Bitcoin holders who have been dormant for three to five years have just recorded their largest cumulative transfer of 2025.

This cohort of investors sent a cumulative 32,300 Bitcoin worth $3.93 billion to exchanges, marking the largest transfer of this segment year-to-date, according to data shared by CryptoQuant analyst Maartunn on Tuesday.

Large-scale selling from previously dormant Bitcoin whales was among the main reasons limiting Bitcoin’s price action in August, according to popular analyst Willy Woo.

“BTC supply is concentrated around OG whales who peaked their holdings in 2011,” who bought Bitcoin below $10, said Woo in an Aug. 25 X post.

“This differential in cost basis, the supply they hold and their rate of selling has profound impacts on how much new capital that needs to come in to lift price,” he added.

However, Bitcoin may be poised to outperform other crypto assets, despite concerns about whale selling and widespread calls for the start of an altcoin season, according to Matrixport.

“Over the past two months, Bitcoin dominance temporarily declined as ETH and select alts outperformed, but that trend is now reversing – signaling that Bitcoin is once again reclaiming leadership in this cycle,” the company wrote Wednesday on X.

Matrixport added that while there have been “countless” calls for an altcoin season, the current rally remains “selective rather than broad-based.”

https://www.youtube.com/watch?v=haInlj7rTSs

Magazine: Bitcoin is ‘funny internet money’ during a crisis: Tezos co-founder