Why Coinbase and OKX want a slice of Australia’s $2.8T pension pie

How SMSFs are opening Australia’s pension market to crypto

Australia’s 4.3-trillion-Australian-dollar pension system, which is approximately $2.8 trillion, has presented a significant growth opportunity to crypto platforms across the world.

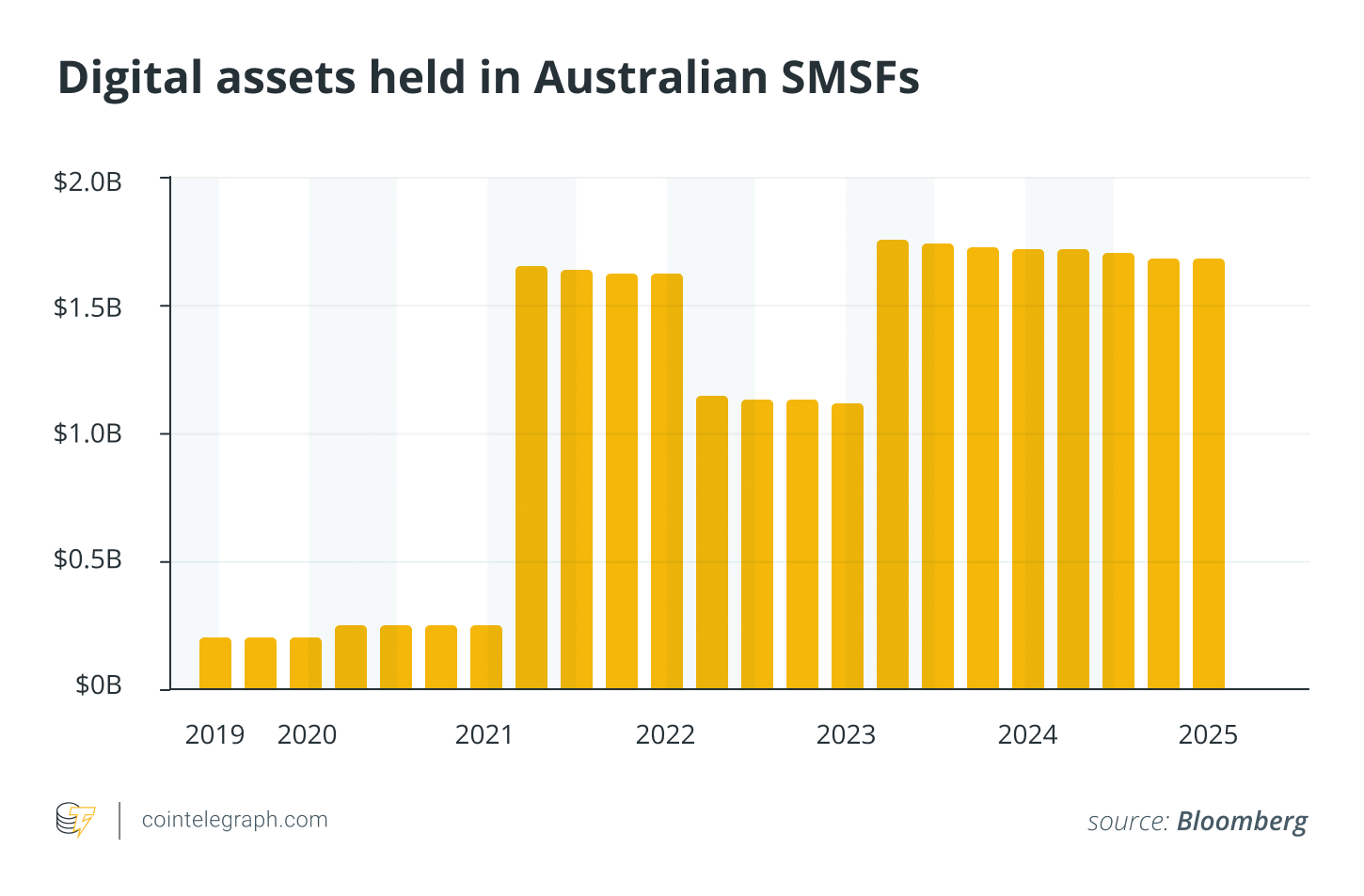

Self-managed super funds (SMSFs), which let Australians manage their own retirement savings, have become a key entry point for crypto. Platforms like Coinbase and OKX see them as a way to position digital assets within long-term wealth strategies. As of 2025, SMSFs hold about 1.7 billion AUD in crypto, a sevenfold jump since 2021.

The efforts of global crypto exchanges like Coinbase and OKX to engage SMSFs in Australia have come at a time when Australians are seeking new investment options beyond traditional stocks and mutual funds. Global crypto-friendly policy changes, such as the Trump administration’s decision to permit cryptocurrencies in 401(k) plans, have also encouraged Australian investors with pension funds to invest in crypto.

What are SMSFs in Australia?

SMSFs in Australia are a private superannuation structure where members take full control of their retirement savings. Unlike traditional super funds, SMSFs allow up to six members, usually family members, who act as trustees.

SMSFs are responsible for managing all investments and compliance directly with the Australian Taxation Office (ATO). One to six individuals can come together to form an SMSF.

SMSFs are largely unique to Australia. The closest equivalents of SMSFs in the US are employer-sponsored 401(k) plans and individual retirement accounts (IRAs).

Key characteristics of SMSFs

- Control: Members directly choose and manage investments.

- Flexibility: Ability to invest in diverse assets, including real estate.

- Responsibility: Trustees are legally accountable for audits, tax compliance and financial reporting.

- Cost: Typically cost-effective only for balances around 200,000 AUD.

SMSFs only become cost-effective to operate when the fund balance is above a certain range because of annual compliance, audit and administrative costs that the SMSFs have to bear, regardless of fund size.

Why people choose SMSFs

- Greater control over retirement funds

- Ability to purchase expensive property through super funds

- Personalized investment strategies.

Key responsibilities of trustees

- Set up and follow an investment strategy

- Maintain accurate records and member balances

- Arrange annual audits and tax returns

- Ensure compliance with super and tax laws.

Did you know? US-based Strategy (formerly MicroStrategy) has become a poster name for institutional Bitcoin (BTC) adoption. By September 2025, it held 638,985 Bitcoin (BTC), with an average purchase price of $73,913 per BTC.

Why Coinbase and OKX are targeting SMSFs in Australia

Coinbase and OKX are focusing on Australia’s SMSFs because of their substantial economic volume. As of September 2025, there were 653,062 SMSFs in Australia, with a total of over 1.1 million members.

Deloitte expects Australia’s superannuation system (not SMSFs specifically) to grow from $4.3 trillion AUD to approximately $17 trillion AUD by 2043 (figures adjusted to AUD). Unlike conventional pension funds, SMSFs provide investors with the flexibility to diversify their asset allocations, making them well-suited for cryptocurrency investment.

Coinbase and OKX are strategically targeting SMSFs to meet growing demand.

Coinbase is developing a specialized SMSF service, which has already garnered significant interest, with over 500 investors on the waiting list, 80% of whom are expected to create new SMSFs. These investors plan to allocate an average of $67,000 to cryptocurrency, indicating a growing mainstream interest in digital assets for retirement portfolios.

Meanwhile, OKX took the lead by launching its SMSF product in June 2025, and the demand has exceeded expectations. OKX’s advantage lies in its simplified approach, providing not only crypto access but also connecting clients with accountants and legal advisers to facilitate SMSF setup and compliance.

These efforts highlight how global exchanges are tailoring their strategies to Australia’s distinctive retirement savings market, where the scale and regulatory environment position SMSFs as a key entry point for cryptocurrency adoption.

Multiple catalysts behind the move of Coinbase and OKX

The efforts of Coinbase and OKX to enter Australia’s SMSFs are fueled by local demand and global policy changes. SMSFs, which typically invest heavily in infrastructure assets such as toll roads and ports, are now encountering liquidity challenges and market volatility.

Digital assets provide not only diversification advantages but also the potential for returns that are not tied to traditional markets. Globally, policy developments are lending credibility to this trend. For example, a US executive order allowing cryptocurrency inclusion in 401(k) retirement plans indicates that digital assets are becoming part of mainstream retirement strategies.

This global context strengthens confidence among Australian investors and regulators. Together, these factors explain why exchanges like Coinbase and OKX view SMSFs as a key opportunity for incorporating cryptocurrency into long-term savings.

Did you know? In a US Securities and Exchange Commission filing in February 2021, Tesla declared that it had bought $1.5 billion worth of BTC. The company also said it would accept BTC payments for its products, though it later paused payments, citing environmental concerns.

Regulatory and risk landscape of crypto investment for SMSFs in Australia

Crypto regulations in Australia are evolving. The treasury plans to introduce new laws to better integrate digital assets into the economy. These regulations will specifically focus on providers that handle crypto custody and on stablecoins, while smaller operators will potentially be exempted from these rules.

The Australian Securities and Investments Commission (ASIC) regards cryptocurrencies to be highly volatile and recommends that SMSFs consult professional financial advisers before investing superannuation funds in digital assets. Enforcement efforts have increased, with AUSTRAC and the Australian Taxation Office (ATO) targeting cryptocurrency exchanges to ensure compliance with Anti-Money Laundering (AML) and counter-terrorism financing regulations.

Australian authorities have been actively closing down fraudulent websites engaged in crypto-related fraud and imposing penalties on non-compliant exchanges. To tighten regulatory norms, new licensing requirements have been introduced. The ASIC requires crypto operators to obtain an Australian Financial Services Licence (AFSL). Transitional arrangements are in place in Australia, and a formal regulatory framework is expected to come into place in 2025.

The regulatory regime in Australia allows SMSFs to invest in digital assets, though the crypto service providers need to align themselves with regulatory norms.

Did you know? In 2021, Houston’s Firefighters’ Relief and Retirement Fund became one of the first US pension funds to invest in Bitcoin and Ether (ETH). This milestone demonstrated how even traditionally risk-averse institutions began dipping into digital assets to diversify and potentially enhance long-term retirement returns.

Is Australia shaping global crypto retirement plans?

Global cryptocurrency platforms such as Coinbase and OKX, focusing on Australia’s SMSF market, highlight increasing international interest in institutional-grade cryptocurrency services.

The trend is likely to influence other retirement systems globally. The impact of SMSFs investing in digital assets will be visible across the Australian borders. It might accelerate the adoption of crypto by retirements funds and regulators.

If the Australian experiment succeeds over a longer term, it might serve as a potential model for institutional cryptocurrency adoption. Professionally managed super funds across the world might adopt similar strategies. As demand for crypto investment options in superannuation funds rises, regional regulators may develop custom frameworks to address volatility, compliance and fiduciary risks.