OpenAI Signs AMD GPU Deal Days After Nvidia’s Investment Plan

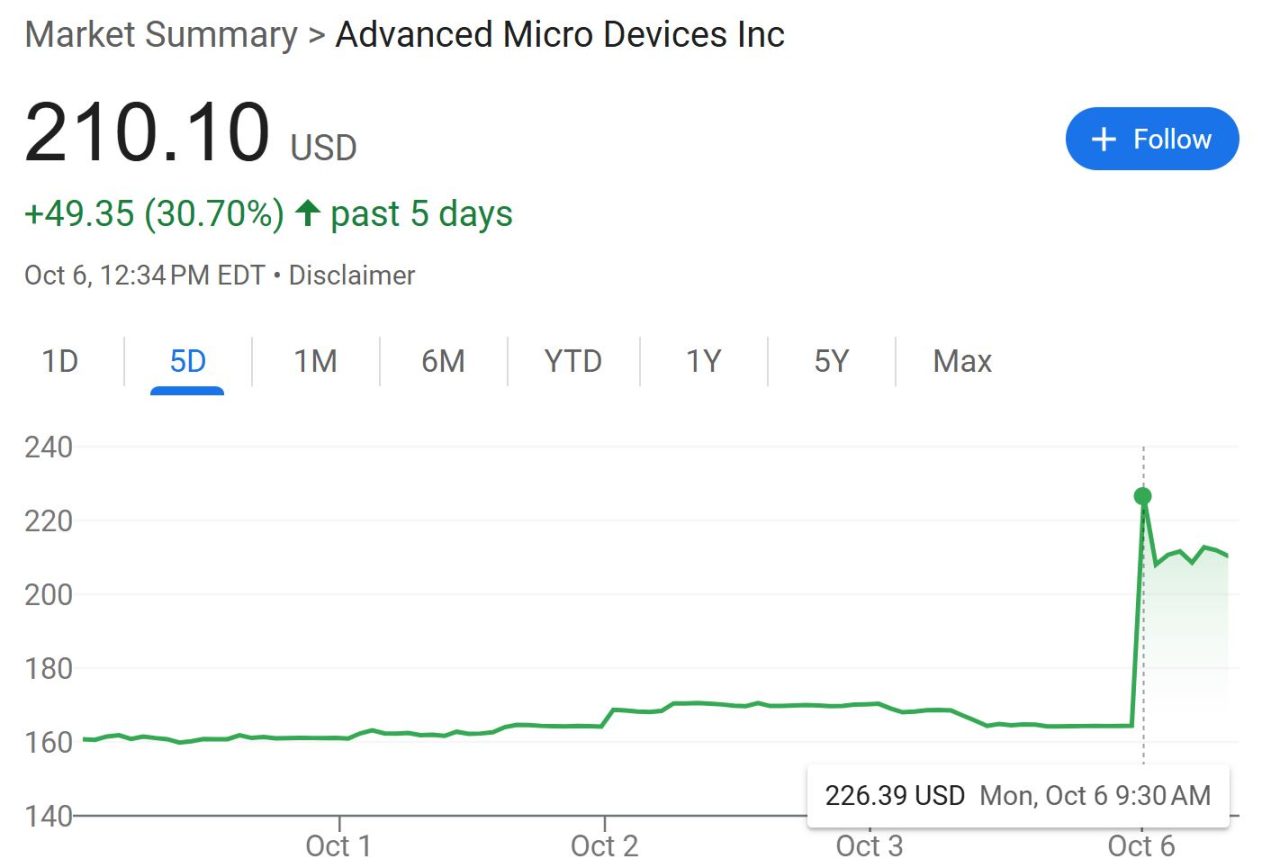

OpenAI and AMD announced a multi-year partnership to deploy up to 6 GW of AMD GPUs for AI infrastructure. The first 1 gigawatt will use MI450 chips and is slated for 2026. The agreement includes a warrant for about 10% of AMD shares, tied to deployment and share-price milestones.

AMD and OpenAI have signed a multi-year, multi-generation deal that begins with the Instinct MI450 and extends to future Instinct products. The first 1 gigawatt build is planned for the second half of 2026; the locations have not yet been disclosed.

The agreement includes a warrant that gives OpenAI the option to buy up to 160 million AMD shares, roughly 10% of the company, if deployment and share-price milestones are met. AMD estimates the total revenue impact over the life of the deal to be tens of billions of dollars.

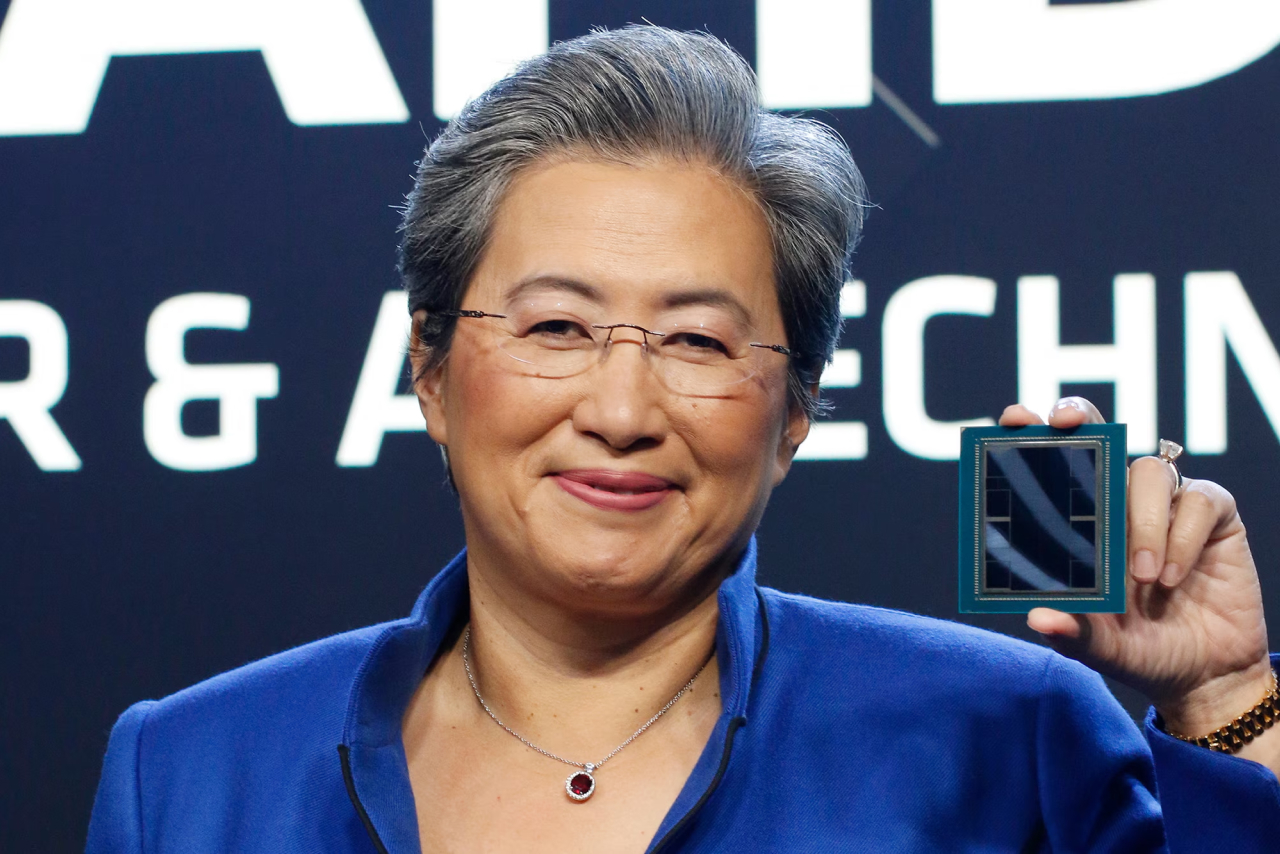

AMD CEO Lisa Su said: “This partnership brings the best of AMD and OpenAI together to create a true win-win”. OpenAI CEO Sam Altman stated: “AMD’s leadership in high-performance chips will enable us to accelerate progress”.

September AI hardware deals recap

In September 2025, Nvidia inked two framing deals for OpenAI’s compute plans. On September 18, Nvidia announced that it will invest $5 billion in Intel and co-develop multiple generations of data-center and PC products. Intel will design custom x86 CPUs for Nvidia’s AI platforms, provide advanced packaging, and link the chips via NVLink.

On September 22, Nvidia and OpenAI signed a letter of intent to deploy at least 10 GW of Nvidia systems starting in H2 2026, with Nvidia intending to invest up to $100 billion in OpenAI as each gigawatt is deployed. Together, these moves tighten Nvidia’s role in OpenAI’s stack while securing CPU and packaging pathways beyond TSMC.

Put simply: OpenAI secured an option to buy up to 160M AMD shares—days after Nvidia outlined plans to invest up to $100B in OpenAI. I can’t quite put my finger on it.

Nvidia remains the dominant supplier of AI accelerators. The AMD-OpenAI pact diversifies OpenAI’s compute sources and opens a larger AI revenue stream for AMD. The warrant links OpenAI’s potential equity to AMD delivery milestones and share-price thresholds, with reported triggers up to $600 per share.

In the short term, the AMD-OpenAI deal means that both high-bandwidth memory and the newest chip capacity will be allocated to data centers instead of gaming graphics cards. That may keep prices higher for all AMD GPUs, and make top-end ones scarcer.

A broader DRAM upcycle is also pressuring prices. GPUs utilize DRAM as a fundamental component, so while suppliers are steering capacity toward HBM and server memory, contract DRAM and GDDR tend to move up after a short lag. For gaming, this manifests as higher bill-of-materials costs on premium GPUs, tighter VRAM configurations, fewer discounts, and gradually rising prices for new PC builds.