Senate Finance Committee to Discuss Crypto Tax Next Week

The US Senate Finance Committee is set to hold a hearing next week to discuss how digital assets should be taxed — seemingly in line with the White House’s crypto report released in July.

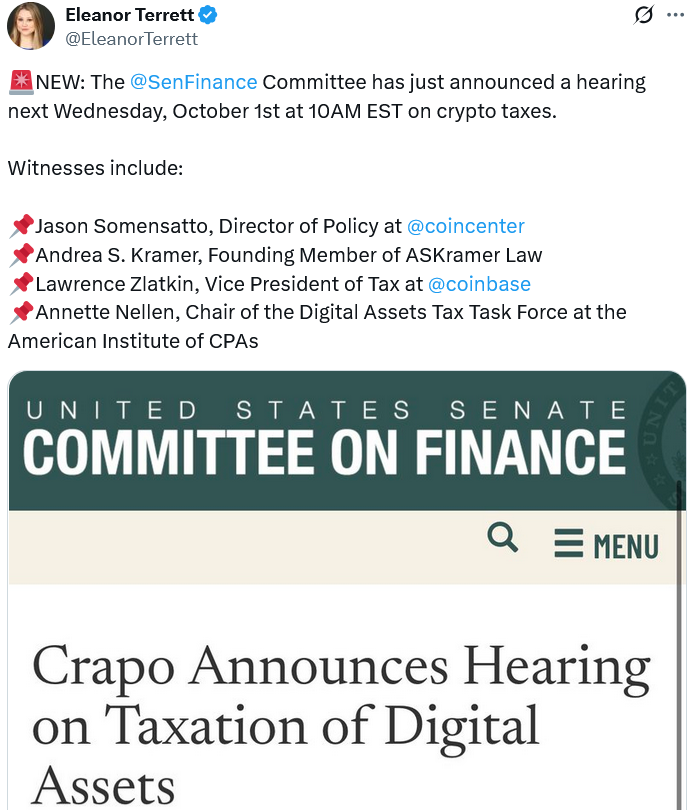

The hearing will be led by the committee’s chair, Mike Crapo, on Wednesday, with Coinbase vice president of tax Lawrence Zlatkin and Coin Center policy director Jason Somensatto to testify, according to the notice released on Wednesday.

It falls in line with the White House Digital Asset Working Group’s crypto recommendations in July, which called on lawmakers to recognize crypto as a new asset class and tailor existing tax rules for securities and commodities to digital assets.

If no legislation is enacted, it calls on the Treasury Department and Internal Revenue Service to issue guidance clarifying how stablecoin payments are taxed and how small amounts of crypto earned from airdrops, mining, and staking should be treated.

The IRS currently treats crypto and nonfungible tokens as property, not currency, meaning any transaction involving these digital assets can trigger a capital gains tax event if sold or transferred at a profit.

Crypto regulation has advanced significantly since Trump returned to office in January 2025, as part of an attempt to boost innovation and retain talent and make up for slow progress seen under the Biden administration, when tax rules were one of many issues confusing industry players.

Senate Finance Committee to hear from American tax experts

The panel will also hear from Annette Nellen, chair of the Digital Assets Tax Task Force at the American Institute of Certified Public Accountants, the notice stated.

Related: Top US Democrat signals fight over crypto market structure

Andrea S. Kramer, a founding member of Chicago-based ASKramer Law, which has a specialty in crypto tax, will also be in attendance.

US Senator wants crypto participants from being taxed twice

Senator Cynthia Lummis has made attempts to address what she says is “unfair tax treatment” of crypto miners and stakers — explaining that they’re taxed twice: first when they receive block rewards and then second when they sell it.

“It’s time to stop this unfair tax treatment and ensure America is the world’s Bitcoin and Crypto Superpower,” Lummis wrote to X back in late June.

Lummis tried to sneak a provision addressing the issue into Trump’s budget reconciliation bill in early July, but it did not appear in amendments brought to the Senate floor before it eventually passed.

Magazine: How do the world’s major religions view Bitcoin and cryptocurrency?