YZi Labs Launches $1B BNB Fund As Token Rallies To New ATHs

YZi Labs, a venture capital firm founded by Binance co-founder Changpeng “CZ” Zhao, is launching a new $1 billion fund for founders in the BNB ecosystem amid the token skyrocketing to new all-time highs.

YZi Labs announced Wednesday a $1 billion Builder Fund to double down on founders in the BNB (BNB) ecosystem, particularly on the BNB Chain.

“BNB ecosystem represents the next phase of digital infrastructure, where decentralization, on-chain scalability converges with security and real distribution,” YZi Labs head Ella Zhang said.

The fund’s launch came shortly after BNB, the native token of the Binance-backed BNB Chain, became the third-largest cryptocurrency by market cap on Tuesday, adding at least $40 billion in market value in October.

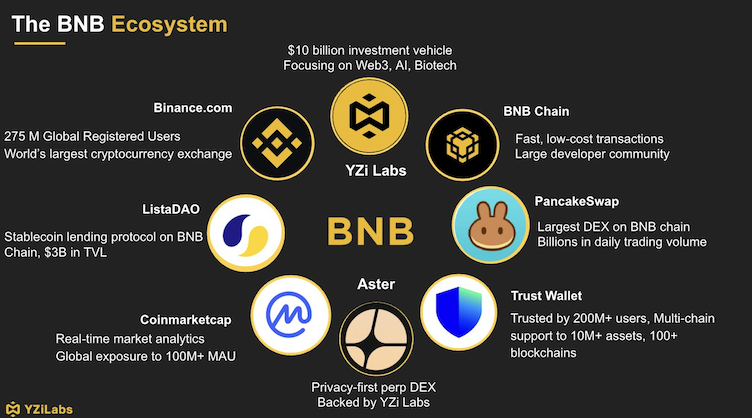

YZi Labs is a serial BNB ecosystem supporter

Formerly known as Binance Labs, YZi Labs has played a crucial role in reinforcing momentum in the BNB ecosystem, funding multiple projects, including Binance-linked decentralized exchange (DEX) PancakeSwap.

YZi Labs has also backed ListaDAO, a decentralized finance (DeFi) protocol on the BNB Chain, the blockchain infrastructure project Aspecta (ASP) and Aster, a multichain DEX that has been recently delisted by major crypto data aggregator DefiLlama.

Additionally, YZi Labs has been advancing institutional BNB participation through projects like BNB Digital Asset Treasury (DAT), the RWA [real-world asset] fund by China Renaissance and the BNB Yield Fund by Hash Global.

$1 billion for multiple sectors

According to YZi Labs’ Zhang, the new $1 billion fund targets supporting BNB builders across multiple sectors, including DeFi, RWA, AI and decentralized science (DeSci). The funding will also seek to support BNB Chain-based payments and wallets, the announcement notes.

As part of the funding, BNB Chain’s flagship accelerator, Most Valuable Builder (MVB), will operate under YZi Labs’ Easy Residency global incubation program as a dedicated track for BNB builders.

Related: Kazakhstan debuts state-backed crypto fund with BNB

Together, MVB and Easy Residency will create a unified program offering up to $500,000 in funding and direct access to the YZi Labs and BNB Chain team, alongside YZi Labs’ network of investors, mentors, partners and user ecosystem.

“We look for early-stage founders building for the long term, with strong conviction, execution capability, and clear product-market alignment,” a spokesperson for YZi told Cointelegraph. The representative noted that the fund will be progressively deployed starting immediately.

Does YZi handle CZ’s BNB estimated at $116 billion?

While YZi Labs has over $10 billion in assets as a global venture capital platform, the firm also reportedly manages billions in assets by Binance co-founders, CZ and Yi He, according to a report by Bloomberg in January.

Although YZi denied functioning as a family office in January, Zhang had previously reportedly claimed that the firm was turned into a “purely a family office investment vehicle.”

“While the capital originates from CZ, YZi Labs’ structure and operations differ from a traditional family office,” a spokesperson from YZi told Cointelegraph, highlighting focus on progressive investments and incubation programs.

Related: Crypto trader turns $3K into $2M after CZ post sends memecoin soaring

Amid BNB posting new historic highs above $1,300, CZ’s personal wealth from BNB exposure has ballooned by billions. With BNB’s market cap reaching a record-breaking $182 billion on Tuesday, CZ could hold around $116 billion in the crypto asset, as previous reports suggested that he held at least 64% of the BNB supply as of June 2024.

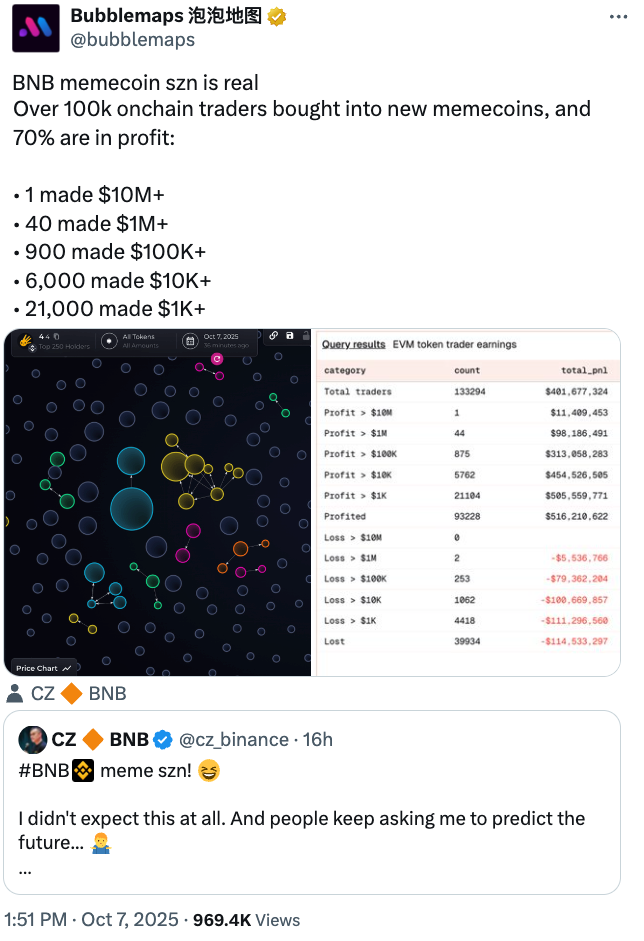

CZ is far from being the only one that profited from BNB’s market surge. According to the onchain analytics platform Bubblemaps, at least 70% of BNB Chain traders are currently in profit, with 40 traders each earning $1 million.

Magazine: Hong Kong isn’t the loophole Chinese crypto firms think it is