Regulation is crucial to unlock trillions in RWAs — AMA recap with OpenEden

Real-world asset (RWA) tokenization has quickly moved from a niche concept to a major focus in blockchain. From the US Treasurys to stablecoins, tokenized products backed by conventional assets serve as a bridge between traditional finance (TradFi) and crypto.

Meanwhile, TradFi takes notice, with major banks exploring tokenized collateral markets and new integrations between onchain assets and legacy systems.

All these shifts are discussed in a recent AMA session of Cointelegraph, featuring Jeremy Ng, founder and CEO of OpenEden. Ng discusses how the sector has grown since 2022, touching on tokenized treasury products and the evolution of stablecoins.

The Future of Tokenized Assets with OpenEden [Brought to you by @OpenEden_X] https://t.co/CUPbKGpVu5

— Cointelegraph (@Cointelegraph) October 1, 2025

Ng’s main takeaway was clear: for institutions to adopt these products, they must meet TradFi standards. He said licensing and regulation are necessary safeguards for investors and the only way to attract large-scale capital to blockchain markets. OpenEden’s CEO still sees regulation as a way to build trust over time. Without it, he warned, the industry risks reverting to the old cycle of fraud and a complete lack of accountability.

Inside the rise of tokenized treasuries and stablecoins

A key milestone for the company was the release of an onchain US Treasury bill fund in 2023, rated AA+ by S&P and A by Moody’s, and custodied and managed in partnership with BNY. For Ng, combining blockchain-based transparency with custodianship signals a game-changer: “You can’t expect institutional confidence without meeting the same benchmarks they recognize,” he said.

Ng also described stablecoins as the essential component of blockchain. He noted that their reserves are already real-world assets, making them a natural extension of tokenization. Although the industry has grown to have over $300 billion in circulation, it still accounts for only a small portion of the world’s total money supply.

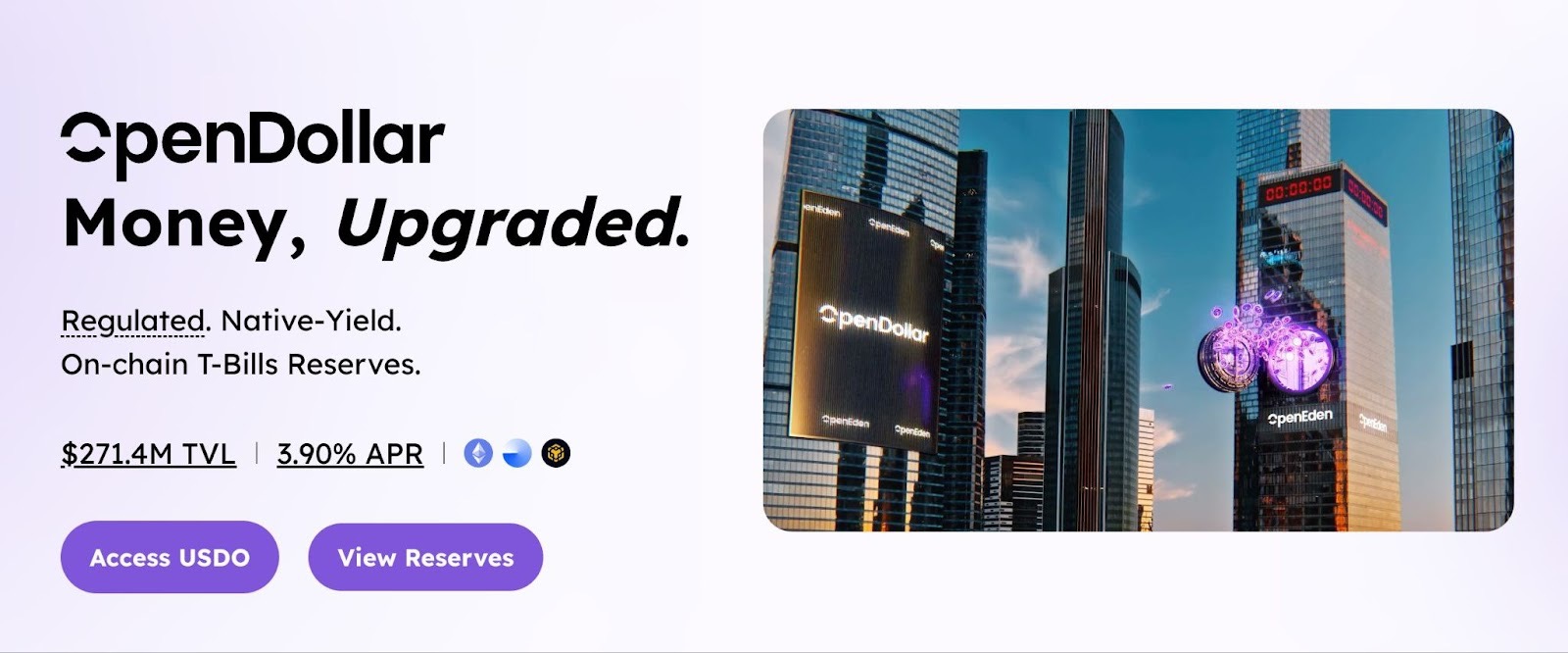

In this environment, OpenEden introduced its own model. The company’s stablecoin, USDO, is issued under a Bermuda license, structured to protect holders in the event of bankruptcy and backed entirely by tokenized treasuries. A wrapped version, cUSDO, is designed for DeFi protocols. Both use real-time proof-of-reserves (PoR) and send earnings directly to holders, differentiating them from existing stablecoins that hold assets offchain.

The discussion also highlighted OpenEden’s partnership with Binance and Ceffu. Under the arrangement, cUSDO has become a yield-bearing digital asset accepted as off-exchange collateral on Binance, while custody remains with independent third parties — a design aimed at lowering counterparty risk for institutional traders.

What comes next for tokenization

Ng expects tokenization to go beyond treasuries and stablecoins to include stocks, real estate and other illiquid assets. He argued that tokenizing property could open access to lucrative markets, like high-end real estate, which are currently limited to the wealthiest investors. However, legal frameworks will be decisive in determining the pace of change.

He acknowledged that finding the balance between innovation and strict compliance won’t be easy, which is why maintaining close communication with regulators is central to his strategy. “If risks are properly assessed and mitigated, regulators are open to innovation,” he said.

Ng closed by stressing that RWA adoption remains in its early stages. Most institutions, he estimated, have yet to enter the market. For him, that gap isn’t a problem — it’s a clear sign of the strong growth ahead.

Find out more about OpenEden

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.